SHORT-TERM: IN WAIT AND SEE MODE

Three cents:

- Could be a Symmetrical Triangle in the forming today, so the bias is up for tomorrow.

- Tomorrow is Non Farm Payroll report day, a typical intraday pattern is to open high go lower or open low go higher. Since the Wednesday’s ADP report is good, so the job data might not be bad, therefore I expect a higher open tomorrow.

- If indeed the market opens high and goes lower tomorrow, the be careful, a top of some kind could be around.

So combining all the factors mentioned above, my guess is we’d see a typical Non Farm Payroll day open high go lower pattern tomorrow and then further pullback the next week. Whether the pullback is to revisit the 11/25 lows or a buyable dip, we’ll have to wait and see.

Why could a open high go lower tomorrow mean a top of some kind?

Highlighted in the chart below are all the recent cases when VIX broke below its BB bottom for 2 consecutive days. Clearly most of them are around a top of some kind. Considering that to guess a top is essentially against the current trend, so I’d require more evidences, therefore if SPY could form another reversal like bar (by opening high then closes lower) tomorrow, plus the hollow red bar formed today, 2 reversal like bars in a row (and don’t forget the VIX chart below), I’d then have enough courage to call the top (I’d, as usual, use lots of might, could, possibly, probably, don’t front run the market, blah blah blah, when I call the top, of course). Considering the typical intraday pattern of a Non Farm Payroll day as mentioned above, to expect a “open high go lower” day, might not totally be a dream.

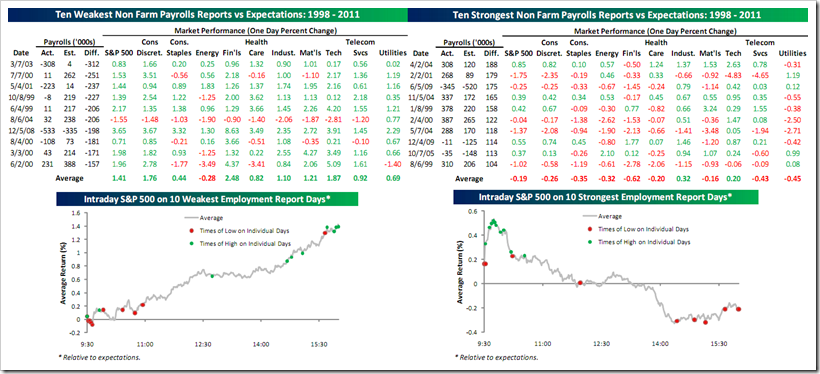

The chart below is from Bespoke, which proves what I said about a typical Non Farm Payroll day intraday pattern, that it either opens high goes lower or opens low goes higher. The reason I mention this chart again and again every month is because there’re always some new readers here. So like a TV program, I have to play it again and again. Hopefully you all could understand, thanks.

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

See 11/18 Market Outlook for more details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: IN WAIT AND SEE MODE

三点说明:

- 今天的intraday pattern可能是个Symmetrical Triangle,因此明天可能还有涨。

- 明天Non Farm Payroll day,intraday pattern是高开低走或者低开高走。由周三的ADP report看,明天的Job数据大概不坏,因此可能高开。

- 明天如果真的高开低走形成反转棒的话,小心,a top of some kind could be around。

综上所述,我猜明天是高开低走,下周开始回调。这个回调是测试11/25 lows的开始,还是buyable dip,要到时候再看。

为什么明天如果高开低走,a top of some kind could be around呢?

下面的图列出了最近所有VIX连续两天跌破BB bottom的情况,可以看到,很多都是在一个顶部附近。考虑到猜顶是反趋势的行为,因此要求需要更严格些,所以如果明天SPY能整一根高开低走的反转棒的话,加上今天的空心红棒棒,连着两根反转棒,加上VIX,那么,喊顶会比较有把握一点。考虑到明天Non Farm Payroll intraday的特征,高开低走的可能性还真是不小。

下面的图来自Bespoke,是关于Non Farm Payroll day intraday pattern的统计,可以看到高开低走或者低开高走的规律很清楚。可能会有同学问,这个图,我每个月都说一遍,为啥现在还说,烦不烦啊?嗯,那是因为不断的有新人加入,所以只能反反复复的说了。这就跟电视节目一样,同样的节目,不也是反反复复的放吗?

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

See 11/18 Market Outlook for more details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

thx, ding

ISEE P/C Index is 50 — extremely low

Thanks. I checked this, didn’t see much edge.

Bullish percentages were all up by several percentage points, exception was BPCOMPQ with only plus 1.92% (BPNDX up 9.52%!) and BPINDU which was flat.

BPSPX was up 3.13%, chart suggests more upside for the next few days. Cobra’s first SPY chart in today’s outlook suggests a reversal on December 6th/7th, BPSPX chart suggests 8th/9th or 12th/13th.

Cobra,

Have you ever taken a look at the performance of your Impulse system bias (what you call “mode”) used as a system (that is, if you simply went long when the bias was bullish and short when the bias was bearish)?

The winning rate wasn’t good, generally OK though. Cannot compare with the detailed signals of course. So nowadays I don’t bother to mention it.

Cobra

New 52 week low in ISEE today.

I know. Check the other comments below. You’ll see the chart as well. Not much edge. I just don’t want to sound bearish, so that’s why I didn’t say anything.

A close look at resistance areas 1245 and 1275. If 1275 breaks market will most likely challenge the highs which were set last summer. (I didn’t want to add the BPSPX here, but Disqus wants to add it too…)

Thanks Cobra! I appreciate your work and commentary!

Thanks