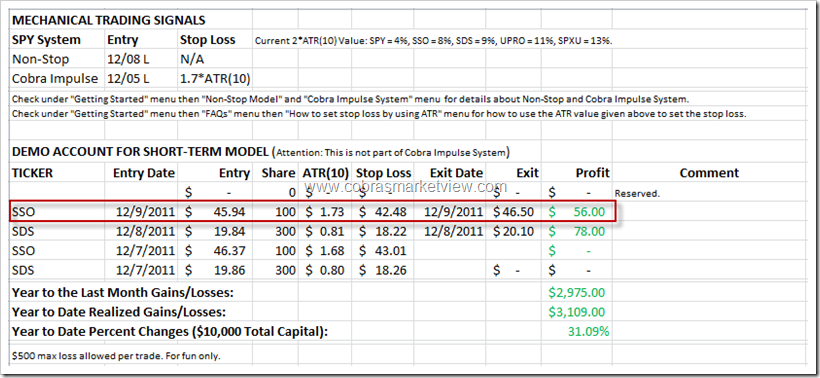

THE SHORT-TERM MODEL BELIEVES THE TREND IS UP HOLDING BOTH LONG AND SHORT (TRAPPED) OVER THE WEEKEND

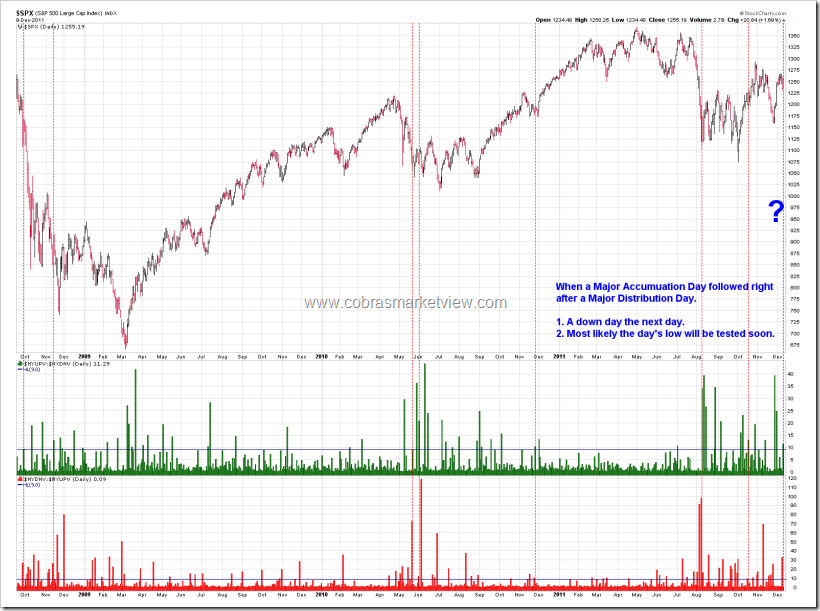

The bottom line, everything goes as planned, so still the Thursday’s low will be revisited early the next week. The chart below should double confirm the evil plan I drew in the last night’s report (missed the lower low part but still a valid plan). This is for short-term of course. The intermediate-term is not very clear now. I do believe Santa Rally, the question is how we get there – up and up until then or down then up until then? I have no answer for now, the only thing I know is the seasonality is very bullish the next week according to the Stock Trader’s Almanac, see Trader’s Calendar at our main page yourself. Enjoy your weekend!

As always, great info and thank you for all your hard work and dedication day in and day out.

Cobra’s genius charts are showing some warning signs. I wonder if they’ll work.

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show%5Bs244426613%5D&disp=P

0.1.1 shows NYADV and NYDNV at extremes!

Normalized CPC is almost too low! 0.3.5

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show%5Bs157645899%5D&disp=P

DWCF Weekly

http://99ercharts.blogspot.com/2011/12/dwcf.html

Have a great one.

thx,ding

Bullish next week, really?

Monday is day #8…

http://www.tsptalk.com/images/112811f.gif

Next week is also OE week, so according to Stock Trader’s Almanac, it’s bullish. I think the statistics for OE week might make more sense.

Go Browns!!!!!

I just checked some of my “special indexes” and they all signaled a bullish signal…. so i feel safe being heavily long despite the fact that we haven’t broken resistance for Sp500 yet.

Yeah, but consensus of the TA community is kind of unusual. All are bullish (I only know of Cobra calling for a short term dip) and I don’t like consensus. I felt much more as ease going long at Thursday’s close than now, when all of us (me too) see more upside. Something is rotten in the state of Denmark (said that famous chartist of human behavior).

BPNYA up 0.96%, BPCOMPQ up 1.19%, BPNDX down 4.84%, BPSPX down 0.97% and both BPOEX and BPINDU flat. As to the sectors: all BPs were either flat or down except BPFINA (financials), which was up 1.25%. BPINFO (technology) and BPINDY (industrials) were down 3.10% resp. 1.64%.

Looks as though small caps are rising, but big caps are stagnant.

BPNDX and BPSPX are at resistance:

I think you might be right and that pent up pressure just might explode through that concrete top.

http://mediacdn.disqus.com/uploads/mediaembed/images/177/2112/original.jpg

A bearish spin on things.

Tis that time of year

Look who’s buying European bonds!

http://www.marketwatch.com/video/asset/george-soros-to-cash-in-on-corzine-mess-2011-12-09/F7C67C77-EA8E-4347-B5CC-A5280C640F84#!F7C67C77-EA8E-4347-B5CC-A5280C640F84

I didn’t like that futures push up after the close. With a weak market structure (melt-up) on Friday it can be a precursor of a substantial drop to test Thursday’s low.