SHORT-TERM: COULD SEE MORE SELLING AHEAD

First of all, members please check if you can login and read inside the Member Only Test Page. Via this test page, I’ve solved lots of cases where people paid but not registered or forgot the password, and since now the requests for the customer services are greatly reduced so I think “the target” of this test page is almost met, therefore starting from the next week, I’d gradually lock in my daily reports (which means you have to login to read). Meanwhile those who’d still like to be a member but haven’t done so, please hurry up. You can click HERE to join us.

I still believe the selling isn’t over yet. See the chart below, I see overlap plus A = B, so the Thursday and Friday’s rebound look pretty much a corrective wave up to me, therefore at least so far I don’t see any evidences that a strong year end rally has started. The thing I’m not sure is whether there’s another push up left on Monday to form a 3 Push Up pattern before reversing down. Such a 3rd push up, if any, is the key to watch:

- If cannot even make a higher high, then it almost confirms that the rebound was over.

- If huge up Monday, then I need review my bearish bias.

Now allow me to summarize all the bearish excuses I’ve mentioned recently.

- 3 hollow red bars (Open low close higher)! So chances are the VIX would rebound which in turn put pressure on SPX, at least SPX wouldn’t be up huge. Besides, although a very low VIX:VXV doesn’t necessarily mean a top now but at least there’s not much room for VIX to drop. So trading wise, if you’re heavily betting on the long side, it might not be a very bad idea to buy a little VIX Futures or ETFs to hedge your position. Please be noted, since it’s just a hedge, so you should be prepared to lose some, as it’s similar to the premium you paid for your insurance, where in most cases, you wouldn’t get the premium back.

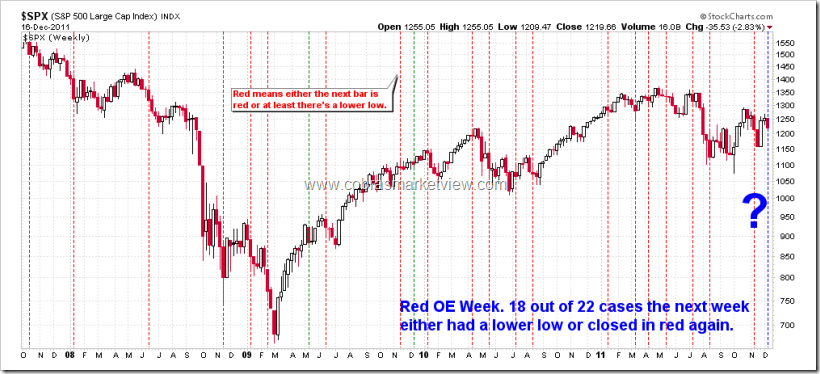

- Because it’s a red option expiration week, so chances are high that we’ll see either another red week or at least a lower low the next week.

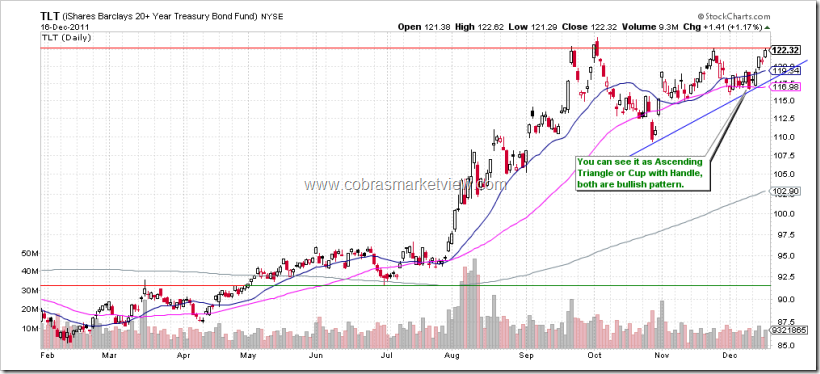

- TLT seems forming a bullish formation. The rise of the TLT usually means the money flows into the debt market therefore is bad for the stock market.

- As mentioned in 12/14 Market Outlook, SPX 3 consecutive red bars usually means a lower close ahead.

- As mentioned in 12/14 Market Outlook, SPY 7 consecutive red hourly bars usually means a rebound (indeed the Thursday and Friday) then pullback again to at least test the 12/14 lows.

- As mentioned in 12/15 Market Outlook, Non-Stop model sell signal has very high chances indicating more selling ahead.

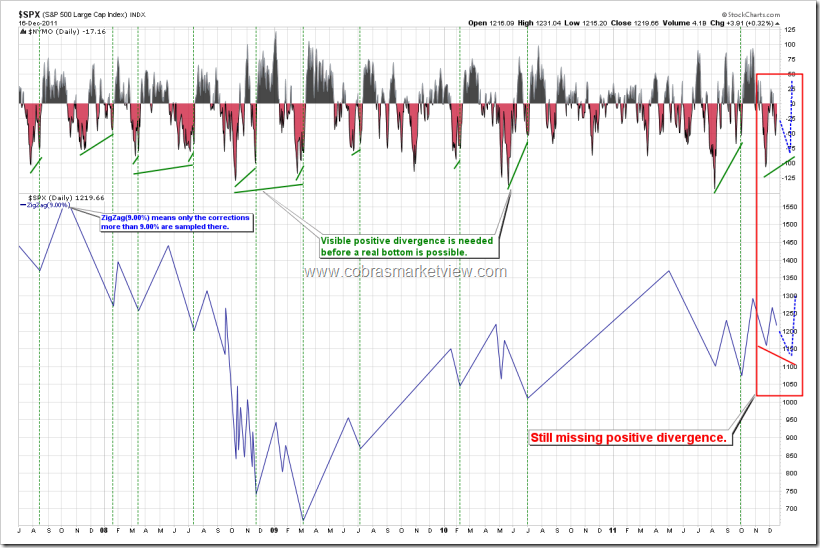

Now let’s talk about the target. I’ve mentioned many reasons in 11/25 Market Outlook that at least the 11/25 lows will be revisited. Chances are the low will be broken, because a visible NYMO positive divergence is needed before a bottom of some kind is possible.

The chart below shows another reason for targeting at 11/25 lows, because rarely had ES (SPX e-mini futures) left a gap unfilled. So the gap shown on the chart is very likely the bear’s attacking target.

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

See 11/18 Market Outlook for more details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Translation

SHORT-TERM: COULD SEE MORE SELLING AHEAD

首先,会员请注意检查自己login以后是否能看Member Only Test Page里的内容。这两天通过这个测试页,我已经解决了大量付费但却没有注册或者不知道自己login密码的情况,这两天明显的要求customer services的少了,因此这个测试页的目的基本达到了。从下周起我会开始逐步锁定我每天的报告(就是说慢慢的所有的报告就只能login才能看了),因此也请还没有入会的同学抓紧时间。加入请按这里。

我还是认为没有跌完。从图形上看,Overlap加A = B,所以周四和周五的反弹仅仅是个corrective up,因此至少目前还看不出来一波强有力的year end rally已经开始了。目前我不确定的是,是否周一还有一次push up,以构成3 Push Up,然后才反转向下。这个the 3rd push up,如果有的话,很关键:

- 如果没有能够higher high就掉下来的话,那么基本就可以确认反弹结束了,下面会继续跌。

- 如果周一大涨特涨,那么我需要重新审视我目前的bearish bias。

下面总结一下最近一段时间提到的看跌理由。

- VIX三个空心红棒棒了(Open low close higher),怎么都该反转了,这个应该对SPX不利,至少不会大涨特涨。另外,虽然VIX:VXV很低,不一定就是顶部,但是至少VIX继续下跌的空间已经不大了,所以操作上讲,如果你多仓很重的话,也许可以买点VIX Futures or ETFs来hedge你的多仓。注意,既然是hedge,就是要准备牺牲的,这个相当于你买的保险,通常premium是白出了。

- 因为本周是red option expiration week,所以很大几率,下周不是收红就是会跌破本周的low。

- TLT看着是要向上突破的样子,一般债市涨,股市会跌,因为钱都跑到债市里去了。

- 我在12/14 Market Outlook里提到了,SPX 3 consecutive red bars,往往意味lower close ahead。

- 我在12/14 Market Outlook里提到了,SPY 7 consecutive red hourly bars,意味着反弹,但是至少还会测试12/14的lows。

- 我在12/15 Market Outlook里提到了,Non-Stop model出sell信号后,下面继续跌的可能性还是很大的。

最后谈一下target。我在11/25 Market Outlook里讲理一大堆理由,都是说11/25 lows至少还是会去测试一下的,且多半会有lower low,因为必须有visible NYMO positive divergence。

下面的图是关于target的另一个理由,很少ES (SPX e-mini futures)会有unfilled gap的,因此下面那么大个gap很可能是熊熊攻击的目标,这个其实也是说11/25的lows还是要去的。

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

See 11/18 Market Outlook for more details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

thx, ding

You give some very valid technical arguments that the selling is not over. The possible downside targets makes sense (fill the 11/29 gap up to perhaps make a double bottom), but if it was that easy then we would all have our own private island somewhere. 🙂

You mean more consolidation and then revisit the 11/25 low? What is your supporting evidence?

great analysis…ding..

Thanks, Cobra!

Great report again!

Love the mobile version

With so many people talking and asking questions about the “correlation” between interest rates and stocks, I did a quick study yesterday that I first posted yesterday on Daneric’s blog (lots of likes, but not much participation with respect to further studies and data put forth – hopefully we’ll see more initiative here), and now here in Market Outlook (an appropriate place, wouldn’t you say?).

http://mediacdn.disqus.com/uploads/mediaembed/images/182/1037/original.jpg

_____________________________________________________

I also extended another note of caution to those who don’t make the effort and prefer to be “spoon fed”:

Don’t get suckered in by the doomsayers. Check out where this “information” got you last year (if you were on the short side, the only thing I can say is that it must have hurt). ZH post out from a little over a year ago: http://www.zerohedge.com/article/arms-trin-index-most-extreme-deviation-1956

Now check out this post I made on the Ticker Forum refuting that disingenuous information: http://tickerforum.org/akcs-www?singlepost=2308289

Finally, check out where stocks went from there, and FOR HOW LONG!!!

_____________________________________________________

Keep perspective folks, and do your own homework.

Hope this is helpful, and to see some of you rolling up your sleeves too. 😉

HighRev,

With all due respect the only equity index up in 2012 that I am aware of is the DJI. Everything else is down and in some cases 20%.

Good reminder Laura, we tend to forget how skewed INDU is. 30 stocks? – come on, IBM and Chevron and that’s it. But INDU’s popularity is unbelievable. In some forlorn place in the world I’ll decipher in the newspaper: US markets were up yesterday, Dow Jones Industrials gained 25 points… It’s one of the best PR tools Wallstreet ever had.

That is fascinating, HighRev, how the major trends are opposites while the squiggles are in sync. One thing that seems certain is that the current squiggle for bond yields is down.

Sort of wish I’d gone short on Friday, but the USD backtest held me back. The hourly dollar chart looks sick to me but in the daily time frame it is still a winner for now. Got to respect positive RSI and MACD trends.

A scenario I think is possible for Bucky is that it is in a long-term ABC up that started in April of 2008 with A completed 3/09 and B in April of 2011 and having a target of about 110.

Cobra:

Great report as always!

However, I hope you are not too bearish biased and neglect the bullish seasonality of December 🙂

Good stuff as usual my friend.

One thing is for sure, next week is volatile. I’ll be playing short term trades with a fistful of minis, expecting a mere 5 – 10 handles. A more important trade might be signalled next Friday.

Whoever wants to play the market less recklessly, bear in mind that GS predicts a 1150/1250 range for the next 12 months. That is, unless Europe’s banks crack…

I’m watching these support and resistance levels:

Going mobile!

One of my trader buddy in Goldman says most traders are already taking vocations from Next monday. And he thinks that is it for this year. So big money already quited the game and banked their money in the bond.

Now, hedge fund will take over the market and use their capital dominance to play the remaining retail investors.

Based on this, I suspect a very volatile coming week.

Close look at the 1 min shows good support at 1205 and at 1200. Small H&S also points to 1200…

What are short term, intermediate and long term time frames?

Generally speaking terms apply to indicators shown by the daily, weekly and monthly indictors. But if you’re a daytrader (as most of us are at the moment) short term might apply to the 1 min chart…

Bloody Monday we shall see. Shanghai index just created a 10 years new low. I see no reason why DJIA can still hold a 1200. Maybe we will more quickly plunge to 1010 than Cobra estimated before.

Not yet dude, it is still above Oct’08, but i believe that low may be breached, possible next year.

Yes, we shall not see 1010 in 1 or 2 weeks, because most pessimists already left the market for vocation.

But they will come back from mid-Jan and attack the equities hardly, using whatever bad news from the Europe.

What I said yesterday proved to be true… You guys should really look into signals from Shanghai as a leading factor for the DJIA…

Chinese stock market are more speculative than investment natured, meaning people there are more likely to forerun. So look at them, they lead every major drop in US in recent days.

Anybody willing to publish every trade to Twitter? http://www.tweeteverytrade.com