|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: MONDAY AFTER MOTHER’S DAY, DOW UP 12 OF LAST 14

SPX TIME AND TARGET ANALYSIS: INITIAL TARGET AROUND 1050ISH, THE PULLBACK SWING COULD LAST TO 05/23

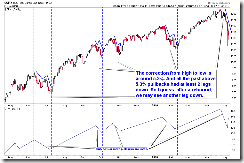

As mentioned in the Friday’s After Bell Quick Summary, a Symmetrical Triangle could mean wave 4, so we might see a wave 5 down first before any meaningful rebound. If the assumption is correct (well, please don’t forget this pre-condition) then the wave 5 target could be around SPX 1040 to 1053, because it’s a multiple Fib confluences area, plus the 02/05 low as the support.

From the chart above, there’s another multiple Fib confluences area around 1008 to 1014 (see chart 4.1.0 S&P 500 Large Cap Index (Weekly) for how I get this Fib confluences area, if interested), that area could be the target for the 2nd leg down. The chart below is just a reminder, maybe some of you have forgotten this. Generally, a strong downward push should at least have 2 down legs and so that’s why I said 1008 to 1014 could be the target for the 2nd leg down.

For the duration of the entire pullback, my guess is at least it should last to around 05/24 (+-). See chart below for the reason. Because the pullback this time is bigger than those of happened in June 2009 and January 2010, so logically, it should last at least no less than the previous 2 times. In another word, at least it should last 17 to 27 calendar days. If , use the longest 27 calendar day to estimate the final date, it’ll be around 05/23.

According to the Gann Day table below, 05/19 to 05/24 happen to have multiple Gann Day clustered together, and 05/21 is also an important solar term date, so this from another aspect, argues that the pullback could last to 05/23 (+-), well, I don’t mean to drop everyday, I mean the trend. By the way, 05/06, I said, it was an important Gann Day and solar term date as well, and you should still remember what happened on that day, shouldn’t you? Anyway, I mean, don’t simply laugh at Gann Theory, any theory that proven work has its merits. And I’ve been trying to integrate them all together, hopefully could dramatically improve the accuracy of my market forecast.

INTERMEDIATE-TERM: 05/06 LOW WILL BE BROKEN BUT NO EVIDENCE SAYS THIS IS A START OF A NEW BEAR MARKET

Maintain the forecast for calling a roller coaster intermediate-term. Even indeed the bear market has started, but because the upward push since the March 2009 was very strong, so generally, bulls won’t give up so easily without any fight, therefore most likely the 04/26 high will be tested and perhaps we’ll see a new high. If at that time, breath (see chart below) couldn’t reach a new high forming a negative divergence, then there’s a chance that the market is really topped. For now, as far as I can see, we’re far from calling an ultimate top yet.

The chart below is to follow up the weekly Bearish Engulfing mentioned in 04/30 Market Recap. Now the year 95 bullish cases can be eliminated, and all the rest cases should be obvious enough to see that they’re not very bull friendly.

The Blue bar in the above chart means after a weekly Bearish Engulfing, the market dropped another week to confirm the pattern. I think you may want to know what happened thereafter because it fits well for nowadays (we had a Bearish Engulfing last week, then a big red this week confirming the last week’s Bearish Engulfing). So I put the zoomed in chart below. All I can see are that for those 4 cases, the lows of the follow through week were all broken eventually. So apply this pattern to nowadays, it would mean that 05/06 low will be broken. By the way, all those 4 cases have at least 2 legs down.

I saw some comments about VIX rising too high too fast. The chart below highlighted all the recent cases when VIX was up more than 30% a day. Again, the green bar lows (i.e. the 05/06 low) were all broken eventually。

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: MORE BULLISH EXTREMES, SO STILL COULD SEE REBOUND SOON

Except mentioned in the Friday’s After Bell Quick Summary, the Bullish Monday and Seasonality, see table above as more bullish extremes are added. So I still expect a rebound of some kind.

T2116, percent of NYSE stocks 2 std dev below MA(40), way too high, from the bull market standard, this already is a record high.

6.1.1b Extreme CPC Readings Watch, CPC >= 1.01, 78% chances a green day the next day.

8.1.0 Normalized NYTV, NYSE total volume too high usually means a capitulation, so there’s a chance that the market could be bottomed (see green lines).

0.2.3 NYSE McClellan Oscillator, way too oversold, in fact it’s the 2nd record low in NYMO history (available from stockcharts). Of course, as mentioned in 05/06 Market Recap, NYMO new low also mean that SPX may have a new low ahead, because usually NYMO has to form a positive divergence before SPX actually bottoms. In chart 8.2.6a Record NYSE McClellan Oscillator Readings 2001-2005 and 8.2.6b Record NYSE McClellan Oscillator Readings 2007-2009, I’ve marked several past NYMO record lows, take a look at what happened thereafter yourself if interested.