|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: A LITTLE BIT BEARISH BIASED THE NEXT WEEK

See 06/04 Market Recap for more details.

INTERMEDIATE-TERM: PULLBACK TARGET AROUND 1008 TO 1019, TIME TARGET AROUND 06/11 TO 06/14

See 06/04 Market Recap for more details.

SHORT-TERM: STILL DOESN’T LOOK LIKE A BOTTOM

Nothing to say today. Just update 2 charts I’ve discussed recently because they’re not in my public chart list, and then show you a few institutional charts. So far all I can say is, IF, history still repeats itself or the past experiences still apply, it doesn’t look like that the market has bottomed.

I’ve mentioned this several times, the NYMO positive divergence is still missing.

I’ve mentioned this chart too, volume doesn’t look like the past bottom pattern.

Below is another evidence for no capitulation: The visits to my blog simply keep dropping which means nobody is nervous (when people are nervous, they will search on the internet for reasons and therefore the visits to any financial blogs will surge). I don’t recall any bottom like this.

Of course, you can say now it’s too obvious not bottomed or too many people too bearish, so MM (so called market maker theory which I don’t believe at all) will push the market higher. Sure, that’s possible, however the Close up chart of Long Term Trending Fed Liquidity and Foreign Liquidity Inflows (courtesy of stocktiming) below does not look like that MM has the money to push the market up.

Again the Institutional Buying and Selling Trending chart from stocktiming, institutions (also part of so called MM) are still in distribution mode.

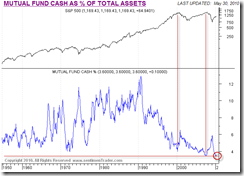

Mutual Fund cash level (courtesy of sentimentrader) is at a historical low, again says that MM doesn’t have money.