|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: A LITTLE BIT BULLISH ON JUNE TRIPLE WITCHING WEEK

See 06/11 Market Recap for more details.

INTERMEDIATE-TERM: BULLS HAVE HOPES BUT STILL SOME BEARISH PUZZLES UNRESOLVED

See 06/11 Market Recap for more details.

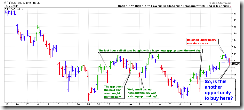

SHORT-TERM: CHART DOESN’T LOOK GOOD

The indices and sectors daily charts don’t look good today, all opened high then went higher high but eventually closed in red, forming a so called Bearish Reversal Day. Take a look all the recent cases on what happened when SPY formed a Bearish Reversal Day (red arrows). A short-term pullback or a few days of consolidation then pullback is more likely, isn’t it? If interested, take a look at some none indices chart, such as 0.2.0 Volatility Index (Daily) and 0.2.1 10Y T-Bill Yield, neither look good as well.

Although technically the short-term is not bull friendly but I’ve mentioned all the recent cases in today’s After Bell Quick Summary that all the sharp sell off before the close were met with a huge huge gap up the next day. Now the question is whether the 3rd time is the charm?

So to summarize, although technically not so bull friendly, but bulls are so blessed recently that every weakness was being bought, so we need see if again the bull's Guardian Angel will arrive tomorrow, until then, it’s still too early for bear to open a bottle of champagne.