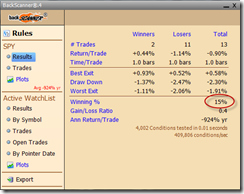

Bearish Engulfing, so champagne for bears? Well, not so fast (I know you know I’ll say this, LOL), assume SPY reaches a 10 days high then reverses back to from a Bearish Engulfing like today, short at close and cover at close tomorrow. Hmm, great, you have 15% chances!

- Getting Started

- Quick Start Guide

- Registration Tutorial

- 3 Different Login System

- We serve mobile contents

- Private Messaging System

- Your safety is my primary concern

- FAQs

- Lost 25%, can I follow you to regain all

- I cannot log in, please help!

- I don’t have PayPal account, can I still be a subscriber

- How to update credit card info

- How to know if I paid with PayPal or via credit card directly

- Payment Skips and Suspension

- How to find a chart in my public chart list

- Could you recommend some trading books

- Chart Legend and Back Test Rules

- Short, intermediate and long term

- Trading School

- Seasonality

- Seasonality by Month and Day

- Holiday Seasonality

- Others

- Average Quarterly Percent Change for Dow

- Trading Thanksgiving Week

- December OE Week Historically Bullish

- Quadruple Witching Expiration Week Bullish

- 5-Week Expiration Cycles

- Christmas Week and New Year Week

- Presidential Cycle Years

- Election Year Dow Returns by Party and Term

- Holiday Weeks

- Martin Luther King, Jr. Week

- January Barometer

- Leap Day Performance

- Sell on Rosh Hashanah and Buy on Yom Kippur

- Up 5-15% YTD Heading Into December

- Last and First Trading Day of Year

- Santa Rally, First Five Days and January Barometer

- First Day of Month

- As Goes IBM, So Goes the Market

- AAII Many Consecutive Weeks of More Bears than Bulls

- AAII Bullish Readings and Market Performance

- Performance after Running Across Even Levels

- Gold Golden Crosses

- Gann Pivot Date

- Resources

- Quick Links, to be Edited

- Free Commentry

- Login

- Signup

- Contact Us

Select Page