|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

SEASONALITY: NO UPDATE

INTERMEDIATE-TERM: STATISTICS ARE BEARISH

See 08/20 Market Recap and 08/24 Market Recap for more details.

SHORT-TERM: HEAD AND SHOULDERS BOTTOM IN THE FORMING?

In 08/24 Market Recap, I said that around 08/26(+-) could be a pivot date, if SPX pullback to 1040 around this pivot date, then there’s a chance that a Head and Shoulders Bottom could be in the forming. This was exactly what happened today. The SPX got support around 1040 and rebounded to form a bullish reversal bar, looks not bad. Well, does this mean that the market has bottomed? All I can say are maybe, could be, probably, possibly. Need see a follow through tomorrow for sure.

0.2.0 Volatility Index (Daily), VIX formed 2 reversal bars in a row, therefore may pullback further which is good for the stock market. Besides this, I have lots of other daily charts showing bullish reversal bars. So overall, daily charts look not bad.

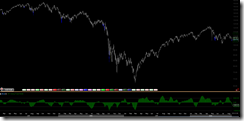

If you’ve read SPY ST Model Cover Short Signal then you should know a blue bar cover short signal was given by the SPY ST Model today. The chart below shows all the blue bars in recent years. As you can see, although they may not be exactly THE BOTTOM but generally should be close enough, so I think today’s blue bar can be treated as another evidence that the market might have bottomed.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTMFS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | DOWN | SELL | |

| IWM | DOWN | ||

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | *DOWN | SELL | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| EUROPEAN | DOWN | ||

| CANADA | UP | SELL | |

| BOND | UP | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). | |

| EURO | DOWN | SELL | |

| GOLD | UP | *BUY | |

| GDX | UP | *BUY | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. |

| OIL | DOWN | ||

| ENERGY | DOWN | ||

| FINANCIALS | DOWN | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? | |

| REITS | DOWN | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging, be careful. | |

| MATERIALS | DOWN | SELL |

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.