|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: COULD SEE MORE REBOUND, DON’T EXPECT TO GO VERY FAR THOUGH, THE NEXT PIVOT WINDOW IS FROM 11/24 TO 11/26

Three things to say:

- Not sure whether the rebound is over. I will temporarily assume more to go.

- Don’t expect the rebound to go too far, so maintain the forecast for expecting a 2nd leg down.

- The next possible pivot time window is from 11/24 to 11/26. My guess is it could be the pivot top.

Now let’s talk reasons. All are not very solid, so I’m actually neutral now (aka clueless), will have to wait and see.

Why the rebound may have more to go?

1.0.1 S&P 500 SPDRs (SPY 15 min), could be a Head and Shoulders Bottom breakout, the text book target is $122.63.

The next week is Thanksgiving shortened trading week (close on Thursday and half day on Friday), the seasonality was bullish which according to the Stock Trader’s Almanac (2010), we should buy Tuesday then sell Friday. Hold until the next Monday after Thanksgiving week however, was a bad idea especially since year 2004.

Since 1988, Wednesday – Friday, gained 13 of 22 times (59%), with a total Dow point-gain of 657.51 versus Monday’s total Dow point-loss of 870.79, down five straight 2004 – 2009. The best strategy appears to be coming into the week long and exiting into strength Friday.

Why I don’t expect the rebound to go too far?

6.2.3 VIX:VXV Trading Signals, as already mentioned in 11/18 Market Recap, VIX:VXV is too low, and it’s still pretty low on Friday.

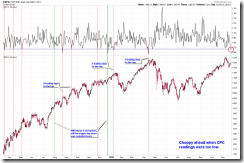

0.2.2 Extreme Put Call Ratio Watch, it seems CPC too low wasn’t a good sign, well, mostly.

1.2.0 INDU Leads Market, INDU had a lower low already which could imply that SPX will have a lower low eventually. Refer HERE for more evidences about INDU Leads Market, if interested.

1.1.0 Nasdaq Composite (Daily), looks like it’s very hard for COMPQ to hold its 10th gap. The anatomic charts below should be clear why I said COMPQ could hardly hold its 10th gap. Besides, if history could repeat this time, then at least 3 gaps would be filled before the pullback ends. This looks very substantial which I believe nobody would believe at the current stage. Well, let’s see.

Why the next possible pivot time window is from 11/24 to 11/26? Why I think it could be the pivot top?

See chart blow, lots of reasons:

- Multiple Gann Day due from 11/24 to 11/27.

- Have you noticed that so far lots of important pivot date this year happened on month day 25 to day 27? Don’t believe such kind of date coincidence? Well, then how do you explain the magic day 6 I mentioned before as we just experienced the 02/05 bottom, the 05/06 crash and perhaps the 11/05 top?

- 15 week cycle due on week 11/26.

- The rebound so far this year, mostly took 5 to 7 trading days. The rebound now takes only 3 trading days, so could be 2 to 4 more trading days to go, which happens to be around 11/24 to 11/26.

- Remember the Thanksgiving seasonality mentioned above? It’s bullish until 11/26. The next Monday, however was bearish especially since year 2004. This also fits well with my seasonality chart 6.5.2c Week Seasonality Watch and 6.5.2b Month Day Seasonality Watch, which say the last trading week as well as the last 2 trading days each month since August 2009 were bearish. This, by the way, is the major reason, I think 11/26 could be the pivot top.

INTERMEDIATE-TERM: THE FIRST 2.5%+ PULLBACK AFTER A 40+ STRAIGHT UP TRADING DAYS WAS USUALLY A BUY

See 11/12 Market Recap for more details.

SEASONALITY: THANKSGIVING WEEK ARE KNOWN AS BUY TUESDAY SELL FRIDAY BUT I DON’T SEE MUCH EDGE SINCE 2004

According to Stock Trader’s Almanac (2010), since 1988, Wednesday – Friday, gained 13 of 22 times (59%), with a total Dow point-gain of 657.51 versus Monday’s total Dow point-loss of 870.79, down five straight 2004 – 2009. The best strategy appears to be coming into the week long and exiting into strength Friday.

The seasonality chart around Thanksgiving below is from sentimentrader.

For November seasonality chart please refer to 11/11 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 11/16 S | |

| NDX Weekly | UP | NASI STO(5,3,3) sell signal. |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | Big red bar means more pullbacks ahead, so be careful. | |

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 11/16 S | |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 11/16 S | |

| GDX Weekly | UP | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | %B is too high with negative divergence. |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 11/16 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.