|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: CPCE TOP SIGNAL TRIGGERED BUT NEED A CONFIRMATION TOMORROW

The market chose to breakout on the upside but I’m not convinced yet, as a general pattern, the very first time of a narrow range breakout is usually a false one, the real breakout could be on the opposite side, so at least we need see if the market could follow through tomorrow.

The most important signal today is the 3 points validated CPCE trend line is broken signalling a top of some kind. Those who have been reading this blog for awhile should remember that this is a very reliable top signal, so be careful here. The signal needs a confirmation tomorrow though, i.e. the trend line must hold the pullback, if any, so again, we need see tomorrow.

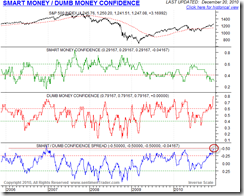

Another thing worth mentioning today is Sentimentrader Smart/Dumb Money Confidence Spread, now it’s the 2nd record high on the chart.

INTERMEDIATE-TERM: COULD BE WAVE 5 UP TO SPX 1300+, PIVOT TOP COULD BE AROUND 01/05 TO 01/12

See 12/17 Market Recap for more details.

SEASONALITY: NO UPDATE

See 12/03 Market Recap for December seasonality chart.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 12/14 S | |

| NDX Weekly | UP | |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 12/02 L | |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | DOWN | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 12/17 S | |

| GDX Weekly | UP | |

| USO | Could be a Pennant in the forming, so more push up? | |

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 12/01 L | |

| XLB Weekly | UP | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.