The bottom line, the short-term trend is up. I hold no position over the weekend.

The market closed strong, looks like it’ll gap up huge the coming Monday, but personally I don’t think the Monday gap if any could hold as there’re simply too many unfilled gaps especially COMPQ which now has 11 high to low gaps. Well, I know you don’t believe this kind of gap stuff, but INDU has been up 5 days in a row, short at today’s close and cover at the first down day close since 1999, you’ll have 67% chances. If another up day for INDU (that’s Monday), short at close than you’ll have 73% chances.

Enjoy your weekend!

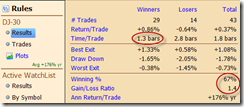

Demo account for short-term model, $200 max loss allowed per trade. Mechanical trading signal, for fun only.

| TICKER | Entry Date | Entry Price | Share | Stop Loss | Exit Date | Exit Price | Profit | Comment |

| SSO | 02/04/2011 | $51.78 | 200 | $50.81 | 02/04/2011 | $51.98 | 40.00 | |

| SSO | 02/02/2011 | $51.72 | 200 | $50.69 | 02/03/2011 | $51.86 | 28.00 | |

| SSO | 02/01/2011 | $51.03 | 50 | $51.23 | 02/02/2011 | $51.62 | 29.50 | |

| SSO | 02/01/2011 | $51.03 | 50 | $49.23 | 02/01/2011 | $51.46 | 21.50 | Partial profit to lock SDS losses. |

| SDS | 01/31/2011 | $22.77 | 300 | $22.09 | 02/01/2011 | $22.09 | -204.00 | |

| JAN | 415.00 | |||||||

| SUM | 330.00 |