|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: MIGHT SEE PULLBACK THE NEXT WEEK BUT THE 04/01 HIGH COULD BE REVISITED FIRST

Two cents:

- Might see pullback the next week, but before that, the 04/01 intraday high maybe revisited.

- The name of the game is still to buy dip. Say, the max loss allowed for a long position is $200, then if there’s any bearish setup the next week, the max allowed for a short position would be $100 for me – that’s half positioned.

As for the arguments supporting a pullback next week, I’ve already mentioned in the Friday’s After Bell Quick Summary:

- The last push up is much weaker which usually leads to a 2 legged pullback.

- However, since the last push up is not too weak so there’re chances that the 04/01 intraday high would be revisited the next Monday.

- If the push up the next Monday is strong then the call for a pullback would be invalid. However, as TICK closed above 1000 last Friday so chances are good that the Monday’s push up won’t be strong which might guarantee my call for a 2 legged pullback.

INTERMEDIATE-TERM: BULLISH APRIL

Three cents:

- April could be very bullish.

- SPX target area 1352 to 1381.

- Bear’s hope is the 04/11 to 04/14 time window.

I’ve seen lots of statistics arguing for a very very bullish intermediate-term. Personally, I believe it’s reasonable to expect a bullish April. The main reason is the strong NYADV which according to the law of inertia, chances are high that the price will keep rising for awhile. The statistics below are from Sentimentrader and Bespoke, should enough prove the NYADV theory I said above. Besides, don’t forget, seasonality wise, April is the most bullish month of the year.

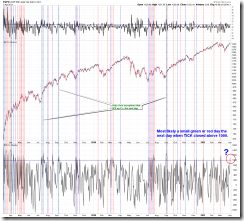

Based on the assumption above, the chart below shows the SPX target area could be around 1352 to 1381 as per Elliott Wave theory. Again, I used the bearish count here as the theory is, even the most bullish count still has to exceeds all the targets calculated by the bearish count.

- C = Fib 61.8*A = 1352.67

- 5 = 1 = 1367.38

- 5 = Fib 38.2% from 1 to 3 = 1376.32

- Fib 78.6% from Oct 2007 Highs to March 2009 Lows = 1381.50

For bears, now the only hope I can see is the 04/11 to 04/14 time window which importance is, I believe, the same as that of July 2009 time window. The difference is it was an important bottom while now looks like an important top. The concept of the time window is similar to the concept of the resistance, which mostly doesn’t work, so it’s not reliable especially now calling for an important top may look insane. So info only, as when I mentioned the 02/18 Pivot Top, I also think it’s insane but it worked unexpectedly, so you never know, maybe unexpected happens again at the most unexpected time of the year?

SEASONALITY: APRIL HAS BEEN HISTORICALLY THE MOST BULLISH MONTH OF THE YEAR

The following statistics is from Bespoke. Apparently April has been the most bullish month of the year for the last 50 years.

The following seasonality chart is from Sentimentrader.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | *UP | NAADV MA(10) is way too high. |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | *Ascending Triangle, so may go higher from here. |

| EEM & Weekly | UP | |

| XIU & Weekly | UP | TOADV MA(10) is way too high. |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | Ascending Triangle, so may go higher from here. |

| GDX & Weekly | 03/30 S | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | UP | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.