SHORT-TERM: REBOUND THEN THE 3RD PUSH DOWN THEN BIGGER REBOUND

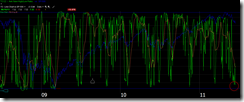

The 2 leg down pattern mentioned in yesterday’s report was fulfilled today, so now I should have a little credit to explain the pattern in more details: Take look at the chart again, watch carefully, well, the exact pattern should be 3 push down, shouldn’t it? So chances are there still is one more push down missing. Just before that, we’ll see a little bit stronger rebound first though.

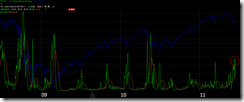

The statistics about VIX closed above BB top for 2 consecutive days below also argues for rebound then pullback then rebound again.

By the way, I see people saying that today’s VIX is repeating that of 03/16/2011. Well, possibly, but isn’t also possible to repeat that of 02/23/2011? Also, according to the law of inertial, since closed above BB top for 2 consecutive days means a strong up momentum, therefore chances are high that after pullback into BB, there’ll be another attempt to break above BB top again. So basically, I believe the rebound we’re going to have is of short-term nature, while the intermediate-term has not bottomed yet.

If, unfortunately, another down day tomorrow, and if you have trapped longs, I think it might be the worst time to panic because all my ultimate weapons for watching oversold conditions are agian almost there now.

Net % of All Sentimentrader Indicators at Extremes

INTERMEDIATE-TERM: STATISTICALLY BEARISH FOR THE NEXT 2 WEEKS

See 06/03 Market Outlook for more details.

SEASONALITY: BEARISH MONDAY AND FRIDAY

According to Stock Trader’s Almanac:

- Monday of Triple Witching Week, Down down 8 of last 13.

- June Triple Witching Day, Dow down 7 of last 12, average loss 0.5%.

Also see 06/01 Market Outlook for June day to day seasonality.

ACTIVE BULLISH SIGNALS:

- 8.1.5 Normalized CPCE: Too high, so bottomed?

ACTIVE BEARISH SIGNALS:

- N/A

ACTIVE BULLISH OUTLOOKS:

- 09/27 Market Recap: 9 POMO within 20 trading days means 14%+ up in 3 months.

- 06/10 Market Outlook: 75% to 81% chances a green next week.

ACTIVE BEARISH OUTLOOKS:

- 06/03 Market Outlook: IWM weekly Bearish Engulfing and SPY down 5 consecutive weeks were bearish for the next 3 weeks.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST:

|

||||||||||||||||||||||||||||||||||||||||||||||||

|