SHORT-TERM: MORE ON THE UPSIDE

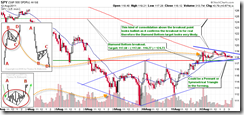

Nothing new, still think the rebound is not over yet, but eventually it would fail. As for why eventually the rebound would fail, I’ve listed all the past analysis in the Active Bearish Outlook session below, so won’t bother to blah blah here again. Chart pattern wise, from different time frame, I see different conclusion where the 15 min chart looks bullish therefore should be more on the upside while on 60 min chart, it’s still a Bear Flag or Pennant therefore eventually will continue lower. As for when the market resumes the downward push, we’ll have to wait for the 15 min chart Pennant or Symmetrical Triangle to complete first.

I know most of you have already seen that SPY weekly Hammer, which looks bullish. The statistics below supports such a view at it seems chances are good for a green next and next next week.

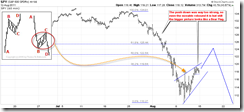

INTERMEDIATE-TERM: CONCEPT ONLY, THE WORSE CASE SPX DOWNSIDE TARGET IS 1,000

See 08/05 Market Outlook for more details.

SEASONALITY: BULLISH MONDAY AND FRIDAY

According to Stock Trader’s Almanac:

- Monday before August expiration, Dow up 11 of last 15.

- August expiration day bullish lately, Dow up 7 in a row 2003 – 2009.

ACTIVE BULLISH OUTLOOKS:

08/04 Market Outlook: Relief rally could be within 3 trading days.

ACTIVE BEARISH OUTLOOKS:

- 08/02 Market Outlook, 08/05 Market Outlook, 08/08 Market Outlook, 08/09 Market Outlook: Rebound, if any, is sell.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|