SHORT-TERM: IN WAIT AND SEE MODE

Key day tomorrow, the pullback, if any, shouldn’t be big otherwise it’s clearly price overlapping which only proves what we had so far is just a ZigZag rebound instead of an impulse wave up. I don’t have any solid evidences to talk you into believing whether it’s a huge up or huge down tomorrow, so will have to wait to see tomorrow. So far the evidences I’ve collected are not very bull friendly, chances for a pullback tomorrow is a little bit higher.

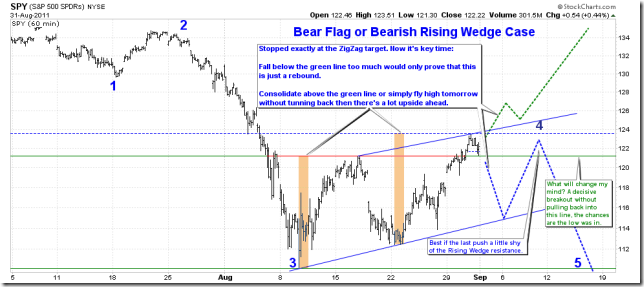

The chart below is my wild guess. For 2 days in a row, the intraday pullback was bought, if however, another intraday pullback tomorrow, then better don’t expect it to be bought again because the 3rd time is the charm.

There’re 3 reasons supporting my above guess. They’re far from 100% guaranteeing the above guess but are undeniably enough for me to make such a guess.

- NYMO cannot go up forever and when the pullback indeed starts, it won’t be small.

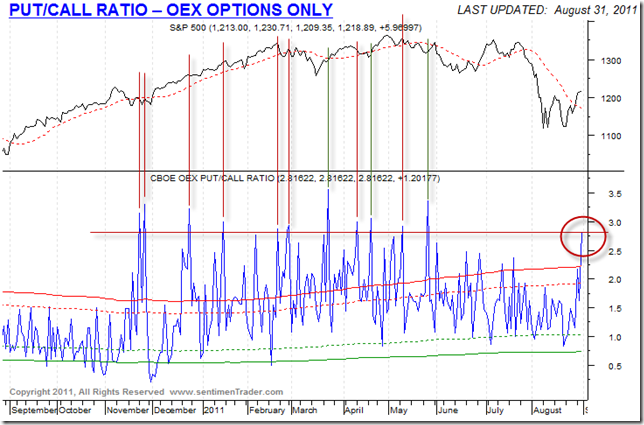

- OEX Put Call Ratio surge, from the chart below, if such a surge happened after a few days upswing (red lines), most likely it would mean at least a short-term pullback.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for more details.

SEASONALITY: BEARISH TUESDAY, BULLISH THURSDAY

According to Stock Trader’s Almanac:

- August’s next-to-last trading day, S&P up only twice in last 14 years.

- First trading day in September, S&P up 11 of last 15, back-to-back huge gains 1997 and 1998, up 3.1% and 3.9%.

Also please see 07/29 Market Outlook for day to day August seasonality chart.

ACTIVE BULLISH OUTLOOKS:

- N/A

ACTIVE BEARISH OUTLOOKS:

- N/A

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|