SHORT-TERM: NOT SURE IF THE REBOUND IS OVER, THE OCT 4 LOW IS THE KEY TO WATCH

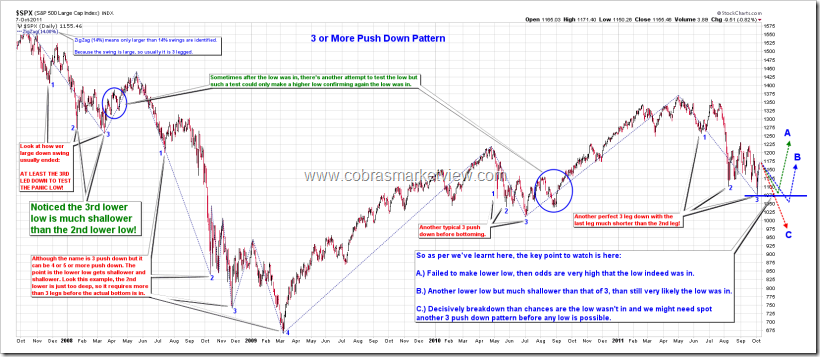

The chart below explains how I read the market:

- Because the 3rd lower low is much shallower than the 2nd lower low, so pattern wise, chances are very high that the Oct 4 low is the low.

- From the fact we had a Red Non Farm Payroll day as well as a Bearish Reversal day this Friday, I cannot exclude the possibility that the rebound since the Oct 4 low was over or very close. Pay attention the wording here, I’m not sure and that’s why I said I cannot exclude the possibility.

- As per 2 judgements above, I believe the route A in the chart below has the best chances that if indeed a pullback the next week, chances are it won’t be a lower low. The route B is essentially the same as route A, so I don’t bother to discuss it here.

- There’s one minor defect for the above judgements though as I cannot explain the NYSI weekly STO sell signal mentioned in 09/30 Market Outlook which pretty much argues that route C has the highest odds. Let me just put this question aside for now as there’re some rare cases the market did rebound for a few more weeks after such a sell signal and plus we could only know C after both A and B are failed so we should have plenty of time to respond if indeed C.

Now let me prove why I cannot exclude the possibility that the rebound since the Oct 4 low was over or very close:

Red Non Farm Payroll day WAS usually a turning point.

Besides the red Non Farm Payroll day, Friday is also a Bearish Reversal Day.

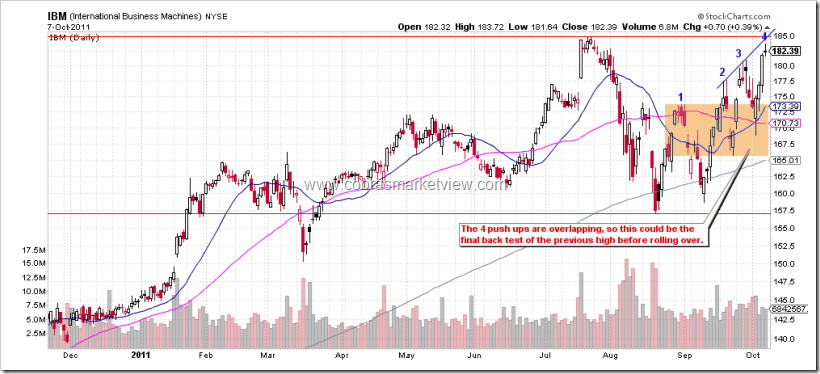

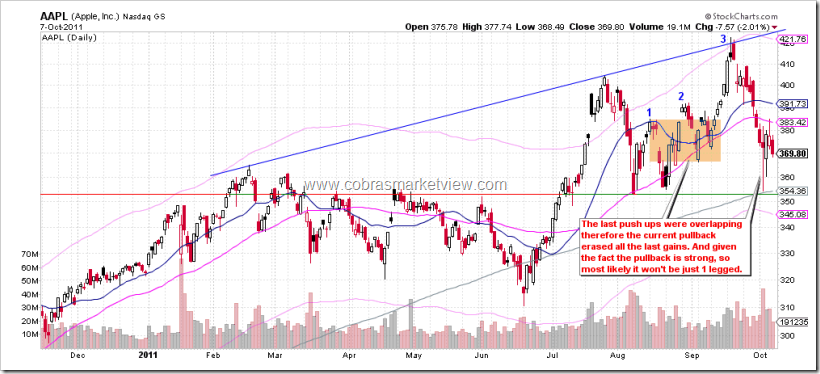

I see price overlay on the IBM daily chart, looks like a 3 Push Up therefore could be a Double Top in the forming. Take a look at the AAPL daily chart below, we should then know what would happen after a 3 Push Up to test the previous high. The AAPL today, could be the tomorrow’s IBM. And since IBM weights more 12% in INDU, so if IBM goes down then so will INDU.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: NO UPDATE

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: NOT SURE IF THE REBOUND IS OVER, THE OCT 4 LOW IS THE KEY TO WATCH

下面的图示意了我对目前大盘的解读:

- 因为the 3rd lower low比the 2nd lower low要浅很多,所以从形态上讲,Oct 4 low是the low的可能性非常大。

- 从本周五的Red Non Farm Payroll day以及Bearish Reversal bar看,不能排除自Oct 4 low以来的反弹已经结束的可能。注意,我不确定,所以我说不能排除结束的可能。

- 根据上面两个判断,我认为下图中A走法的可能性最大,下周如果有pullback的话,多半不会形成lower low。B的走法其实跟A没有多少差别,所以这里就不讨论了。

- 以上的判断,并不能很好的解释09/30 Market Outlook里提到的NYSI Weekly STO Sell signal。几率上讲,C的走法的可能性应该比较大。关于这个疑问,我们先放一放,因为毕竟不能排除少数几个case,大盘连续反弹几周的可能。反正要证明C,至少也是在A和B都失败以后,因此我们有足够的时间准备。

下面证明一下为什么说不能排除在Oct 4 low以来的反弹已经结束的可能:

Red Non Farm Payroll day往往是转折点。

周五除了是red Non Farm Payroll day以外,还是个Bearish Reversal Day。

IBM这一轮反弹overlap的厉害,看着像是3 Push Up,因此很可能是在做Double Top。看看AAPL就知道这样的3 Push Up to test the previous high以后会发生什么了,AAPL的今天多半就是IBM的明天。大家知道,IBM在INDU里占了12%,因此如果IBM不好的话,INDU也不会好到哪里去。

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: NO UPDATE

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

great report. thanks a lot

thanks

thanks

thanks

I was watching IBM as well. Thanks for the support and confirmation of my beliefs. SWEET!

thank you!!

Thanks. need a guide for oncoming week.

Thanks a lot.

Thank you and have a good weekend.

Thank you and have a good weekend.

Apple will have new highs by Christmas ….http://www.bloomberg.com/news/2011-10-08/at-t-says-preorders-for-new-apple-iphone-4s-broke-company-s-sales-records.html

thanks

Great new site Cobra! Look forward to more changes!

Nice website

Great analysis!

Let’s hope for the best for the reversal prediction. I did started my short on Fri before the close …

Great analysis!

Let’s hope the reversal prediction turns out to be correct …

Great site, thanks!

good!thanks!

Cobra,

Could you please do some technical analysis on AAPL? Focusing specifically for the near term (i.e. between now and the end of October). I know that a lot of your followers trade Apple actively and think this would be quite appreciated.

Thanks!

Chris

I think I’ve commented in the post. You might have missed the annotation on the AAPL chart. More likely it’s a 2 legged pullback so after a short-term rebound (may or may not) it would continue down.

Yea, I did see that. I was hoping you might provide more in terms of a target for the pullback and an approximate time frame, i.e. what the likelihood is of the pullback occuring before the Oct 18 earnings versus after. Thanks again!

For now I cannot give more details, need see a few more days. AAPL is part of my daily routine now, so as soon as I see something worth mentioning, I’ll sure post. Thanks. 🙂

Ok good to know 🙂

I’ll be covering shorts somewhere between 325 (23.6% correction) and 340 (20%). More interesting is the long term, IMO one of the best long term shorts. If I had tons of money I’d sell the rebound and wait one, two, three years until aapl comes down to 263 or lower…

Bulls argue that aapl’s P/E is low, but that’s not the point. Point 1 is that too many people/funds are long aapl, no buyers left. Point 2 is that great products will be copied. See what happened to PFE after 1999…

I’m showing some super-highflyers as a reference for my bearish outlook on aapl. I forgot to include goog, correction 2007/08 was 43%, today goog is 30% below the 740 high.

Wow… exactly how long have you been short? Anyone that is short on AAPL, especially long term, it just asking to go broke. 1. Where did you get the notion that there are no buyers left in AAPL? 2. Apple’s products are already being copied, if you haven’t noticed. People don’t want the copies. They want the more expensive “real thing”. There’s only one, little problem with your comparison between AAPL at its recent high and the other stocks at their historical high -> you’re making the assumption that this is Apple’s all time high. And I think it’s safe to say that come January next year you’ll find yourself both wrong, and much poorer. Apple may not go up forever, but it’s always a grave mistake to get prematurely short on companies that are seeing 50-60% growth a year. How many traders lost fortunes trying to short NFLX? And that’s Netflix!

Don’t know how savvy you are, but I guess you are aware that most people think like you…

A guy named singularity initiated my aapl short about 2 weeks ago. He showed a aapl/xlf chart here in Cobra’s blog. I played around with it and changed time horizon and settings – the result was amazing (see attachment) and I immediately shorted aapl.Presumably aapl it will try to rally when it hits 325 or 340, it might rally and go higher than 425 for a few days. But that’s not the issue. The issue is that aapl will crumble long term and will be trading at much lower levels in a few months, a few years. Difficult to get the timing right. I believe that shorting aapl is one of the safest long term bets.

I’d like to add that aapl’s bounce at 354 was due to a Fib sequence and a channel, I don’t know how important this bounce is, but I don’t think it’s important (“think” is always subjective).

Very good point Uempel.

Now what do you think of PCLN, do you think it too is due for a major correction? personally I think its chart looks kinda ugly. it had been 3 push-ups and failed. Then broke down below 200 dma, and barely touch 38% fib retracement of July low. Per chart perspective, I think it will plunge more, however in a mean time I rather wait for it to bounce back close to 200 dma before initiating any short position. My long term target is 61% fib which is 325 to 350ish. Please share with us your thought.Thanks,

Wayne, I don’t follow pcln, don’t know anything about the stock. But I do remember a young UBS banker suggesting I should buy it 12 years ago. That’s a true story, he invited me for lunch and suggested I buy pcln for the ipo. Glad I didn’t. Look at the chart.

Here quick TA, done in 10 minutes. Use this model to check weekly and daily patterns, decide yourself.

nice thx.

Great report as always

Terrific work as always Cobra. One day I wish I could be as good a chartist as you!

Thanks. Just spend a few months reading my posts, you’ll be as good. I only have a few stuff and I simply say them again and again everyday, so not very difficult to do chart analysis. 🙂

Cobra,

Terrific report. Very objective, and congrats on your new site.

From both analysis of AAPL and IBM, it is difficult to see any meaningful bounce for Nasdaq and Indu. However, we can get another bounce from AAPL first before the next leg.

I am a waver kinda guy. I see a lower low with wave 5 of 5 of 1 starting… well, not very certain as many are calling this wave 2 already. And that is the exact reason why I am calling a lower low. Shorted at 1130. A little early and hurting.

Let’s see.

I agree, AAPL may rebound first. It looks to me that everyone are bearish for the next week, so the market might surprise us, I’m afraid.

Congratulations on and good luck with your new site!

I just posted a little something over on Daneric’s blog that I thought you might like seeing. http://danericselliottwaves.blogspot.com/2011/10/elliott-wave-update-7-october-2011.html#comment-330270192

I’ll post it again here for convenience, and we can call it a new website “present” and I kill 2 birds with one stone. 😉

http://www.youtube.com/watch?v=3rfQo9HXmKs

Thanks. 🙂

thanks.

Cobra,

Congrats on the new site! Do you have an RSS feed for this site? I would like to update my blogroll. Thanks!

http://www.cobrasmarketview.com/?feed=rss2

Thanks.

Thanks. You should also make a favicon.ico for your site so that it shows up in the URL bar and will also show up in people’s blogroll. You really do fantastic and thorough work, and I wish you complete success with the new site!

OK, thanks. I’ve told the art designer…

DWCF

Weekly update.

http://bbs.cobrasmarketview.com/viewtopic.php?f=2&t=324&p=31649#p31649

Another great analysis Cobra! That was some exciting bad news good action midday Friday. Hopefully a double top?

http://stockcharts.com/h-sc/ui?s=SPY&p=15&yr=0&mn=0&dy=7&id=p51796473384&a=245448148

thank you so much

Thank you!

Thank you! Seems that EU is ready to save the banks, not sure how much weight it will carry on the market.

Cobra,

You might like to use this plug in for your home page so the most recent post is always shown in it’s entirity. I use it and find it very good:

http://www.dailyblogtips.com/homepage-excerpts-wordpress-plugin/

Thanks. My theme supports full contents, just my images are too large so the right side of the column is covered. Maybe I should use smaller thumbnail.

My image size is 550×317 in order to fit the posts column perfectly. Hope that helps.

Are you using S2 Clean theme from Primo themes?

Mine is also from Primo. They are very good and very customisable. I’ve modified mine a bit so initially it is unrecognisable as one of their themes.

I got you email, thanks. I installed another plugin, so cannot replace that “…” with [continue reading] something.

I’ve tried the plugin, conflicts with my current theme, so I’ll forget about it.

By the way, your blog looks very nice.

Thank you Cobra, that is very kind of you to say.

If only the content was as interesting as yours, I’d be very happy!

Cobra: Do you mean after the coming low which yu call it A/b/c, we will have a continue 2 months rally to year end like the rally from Sep 2010 to Feb 2011?

if A or B, then we’ll see 2 leg up. I don’t know yet how long the rally will last.

If C, then more selling, don’t know where the bottom will be. But I think we still will have year end rally.

Near Term:

——————

SPY tested the 50 day MA in premarket Friday and sold off from there. Keep an eye on 50% retrace of recent rally down at 1123 as an opportunity to take a long side trade. Another test of the 50 day MA above is not entirely out of the question either. So basic trading setup was short at 50 day MA and then long at 50% retrace of rally at 1123. The first part occurred on Friday, now look for a possible re-test of the 50 day MA to go short again or the long opportunity down at 1123 50% retrace level.

Sentiment is still very bearish which bodes well for the bulls… http://www.thetechnicaltake.com/2011/10/09/investor-sentiment-this-is-bullish-because/

Medium term:

——————-

I expect something similar to March-May 2008 and July-Aug 2010 rebounds. Those VIX levels sunk back to where they originated before the selloffs. In this case, a VIX around 22-23 would be the target SPY sell signal.

Long Term:

——————-

1049 level is critical for DeMark system. A monthly close beneath that level, with a lower open the next month, and the door opens for a re-test of March 2009 lows.

10 Yr Treasury yield well below March 2009 levels, suggesting 666 low in S&P 500 will be re-visited

Spuderik: i wish sometime markets can be that straight forward. However, as of now futures are not in agreement with your prediction.

I guess in a grand scheme of thing, market should rally then down as continuation of bear market, but how markets get there only Big Boyz would know. So be cautious and expect a lot of whip saws and volatility

Wayne, above I mentioned either a re-visit to 50 day MA (at 1180ish) or a move to the 50% retrace of the rally at 1123. Right now futures are showing a re-visit is possible. I will short at the 50 day MA visit should we be lucky enough to see it again this week.

I was not awake early enough (as I am in Seattle) to short at the 50 day premarket visit on Friday. In a previous post I said that the 50 day MA visit would be a good selling point, and it proved to be that so far. If you look at previous mini-tops since the swoon began, there are a couple days of lingering around the resistance zone before starting to drop again, so that could very well be in play here.

I am a seller at 50 day MA, and buyer at 50% retrace zone at 1123. Anything in between, and I do nothing. After a visit to 50% retrace zone, if the market holds there, I will hold my position for awhile as I think we will then best the 50 day MA, and potentially test the 200 day MA, though other posters here disagree that the 200 day MA is achievable.

Long term I am super-bearish.

Lets hope that it ll fail at 50dma and not go straight to 38% fib retracement (1195) of July-21 high and Aug-9 low. Keep in mind earnings may be strong catalyst for stocks this wk.

I agree on earnings. I think they will be positive for stocks given the morose sentiment/expectations at present. The market recently stopped at the 50 day EMA when it was the lower of the two (between SMA and EMA), now the 50 day SMA is the lower of the two and the market has been stopped there once already. In particular, it was the 2nd failure at the 50 day (Sept 1st, Sept 20th) that led to the quick selloffs which followed. We have the same setup developing here so far, all we need is a second failure at the 50 day which could occur tomorrow.

I will wake up earlier tomorrow. Fool me once…

I like the 1192/1195 area, note that 55 is now at 1192.

Weekend Report

http://thethoughtfultrader.blogspot.com/

Thanks!

Monday 1.30 am and the futures are way up. Last week bullish percentages were looking good and SPX wants to bust DMA 20 today. If SPX succeeds for more than intraday (i.e. a close above DMA 20) it’s a major breakthrough and could lead SPX to strong resistance up at 1185/1192 (BB 13/1, DMA 55).

At the mom one of my favorite indicators is the RSI 200. Normally very clear signals (exceptions are whipsaws in summer 2010 and bull trap in May 2008). Should RSI 200 go above 50 (and remain above for 2 or 3 days) SPX might try to attack 1210…

Nota bene: very many ifs in these bullish scenarios, but I don’t want to rule them out. Why? Because GS says that equities are priced for the worst case (weekend report last Friday), schaeffersresearch says that HFs exposure to equities is low and that they have 2 trillion to work with…

Ha, trading ain’t easy!

Uempel:

Just curiosity, why 20 periods and 1 stdev for BB, 200 RSI and 55 for MA, Any significances behind these numbers ?

These are (mostly Fib) numbers which have been viable in recent years, that’s why they work. In a few years these numbers might not perform any longer and other numbers will be functioning. There is a rule in TA: all sytems work for a limited amount of time. That’s the hitch with mechanical TA systems, they have a half-life period.

If you are really interested in TA: go read all the books, backtest ideas with a stockcharts account, find your own system – and pls. no more questions until you have read at least 10 TA books…

Cobra- so the low of 1000 is a long term target?

Intermediate-term, couple of months later I guess. I cannot see long-term target.

Nice new site Cobra!