SHORT-TERM: EXPECT PULLBACK AS EARLY AS TOMORROW

Two cents:

- Could see a short-term pullback as early as tomorrow, more likely the day after tomorrow.

- A little bit big picture, still think the market will go the “route A” mentioned in 10/07 Market Outlook. That, there’ll be a pullback, one or two days sharp drop, very scary, but chances are it won’t break below the Oct 4 lows, therefore such a pullback is a buy opportunity. However, I have no solid evidences supporting such a view, it’s mostly based on experiences. For me, trading wise, since I never front run the market, so even the feeling is totally wrong, as long as I strictly follow the market, it won’t go terribly wrong, so please make sure you too, separate the trading reality from the expectation. The key is to accept the reality happily if it turns out to be totally against your original expectation.

Listed below are evidences arguing for a short-term pullback:

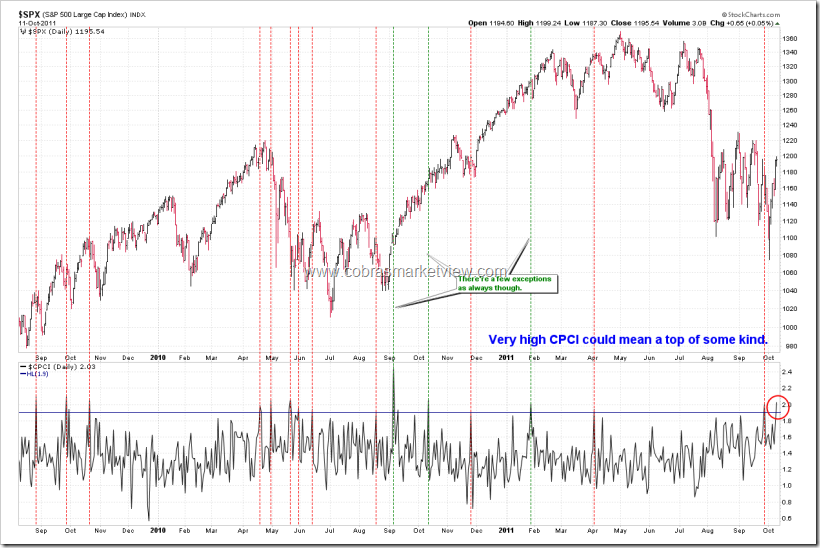

- CPCI is way too high which implies that big guys knew something we retailers yet know therefore hedged their positions in advance. From the chart below, obviously those big guys were mostly right that whenever CPCI suddenly went very high, there’d be a pullback of some kind thereafter, even with those rare 3 exceptions, still some pullbacks 2 out of 3 times.

- ISEE Indices & ETFs Only Index >= 100, 70% chances a pullback within 2 days. The signal went wrong 3 times in a row recently, so if still the winning rate is 70%, chances are this time it’d be right.

- As mentioned in yesterday’s report, TICK MA(3) too high should mean a pullback within 2 days. The signal is valid until tomorrow.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: NO UPDATE

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: EXPECT PULLBACK AS EARLY AS TOMORROW

两点说明:

- 短期可能会有回调,最快明天,后天的可能性更大些。

- 大方向,暂时还是认为我们会走10/07 Market Outlook里提到的route A,就是说,会有pullback,一两天暴跌,比较吓人的那种,但不会跌破10月4号的low,因此这样的pullback是buy的机会。关于这一点,我没有什么证明,纯粹是靠经验和感觉,操作上,反正我是从来不抢跑的,因此既使感觉错了,只要紧紧跟着市场,是不会错得太离谱的,所以注意预期和操作要分开,操作要能经常的很欣然接受预期错误的现实。

下面是关于回调预期的证明:

- ISEE Indices & ETFs Only Index >= 100,70%的机率,两天内会有回调。这个信号,连错3次了,如果还是70%的机率的话,这次错的可能性应该不大。

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000

See 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: NO UPDATE

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Thanks.

thank you!

thanks

Thanks Cobra Thanksss!!!!!

Thank you. GOOG ER after market close the day after tomorrow – Thursday close.

Normally GOOG will show us something.

If you have time, I mean really not very busy, would you mind sharing your opinion about GOOG ?

Did not wanna waste your valueable time. Busy, then ignore it.

Anyway, thank you very much.

http://www.cobrasmarketview.com/?p=2433

thanks a lot

Thanks

thanks!

thanks!

okay so i said a pop to 1205…1199 good enough….should see a drop of some kind. Also the QQQs hit trendline resistance on the daily. Too lazy to post a chart. 🙂 Just believe it.

Thanks for the insight!

Cobra: ISEE for All Indices & ETFs Only > 100; how bullish would you say, a lil bit, mild, or very? I can see that if its too bullish then should turn down for a pull back, but I have no clue how much greater than 100 is considered as an extreme.

CallsPutsTotalISEE180117164080344197110

> 100 means too bullish.

Cobra: why the pull back need to be day after tomorrow?

Because today’s 2 evidences show more likely it’s the day after tomorrow.

i’m awaiting the pullback as well. i have some shorts ready but the pullback will be over quickly i think.

roadmap for wednesday is ready for anyone interested. click on my name for the link.

Read some comments from outside, all consider mkt is going to consolidate at current lever, then go to 1250.

Hutong are on bear side.

Hmm, good question. I don’t have the answer. Maybe my expectation is wrong, we don’t pullback at all like the past 2 years.

THX!!!

Bullish percentages are up and away, BPCOMPQ is weakest with plus 7.03%, BPNDX strongest with plus 22.22%. Charts of BPNYA and BPSPX both show more upside.

But SPX P&F shows a wall at 1200, and don’t forget 377 DMA is at 1212 (not shown here). It’s very unlikely that these two will break easily.

Bottom line: I’m bullish, as BPs are very strong and DMA 55 at 1185 has been broken, but careful because 1200 and 1212 might spoil the bullish set up. Go figure…

班长,那么这个统计还工作吗?

Not recently.

laoda is so handsome~~~