Tip: Now you can use shortened name: www.cobrav.com to access Cobra’s Market View.

SHORT-TERM: IN WAIT AND SEE MODE

Three cents:

- Could see red day tomorrow and more likely today’s low will be revisited. I don’t mean to revisit today’s low tomorrow though.

- More up ahead.

- FEELS no good about the market but I don’t have any solid evidences. If you’ve been watching my intraday comments, you probably know that my feeling is not bad, so nowadays I dare occasionally mention how I FEEL, hopefully you don’t mind, I know it’s not objective.

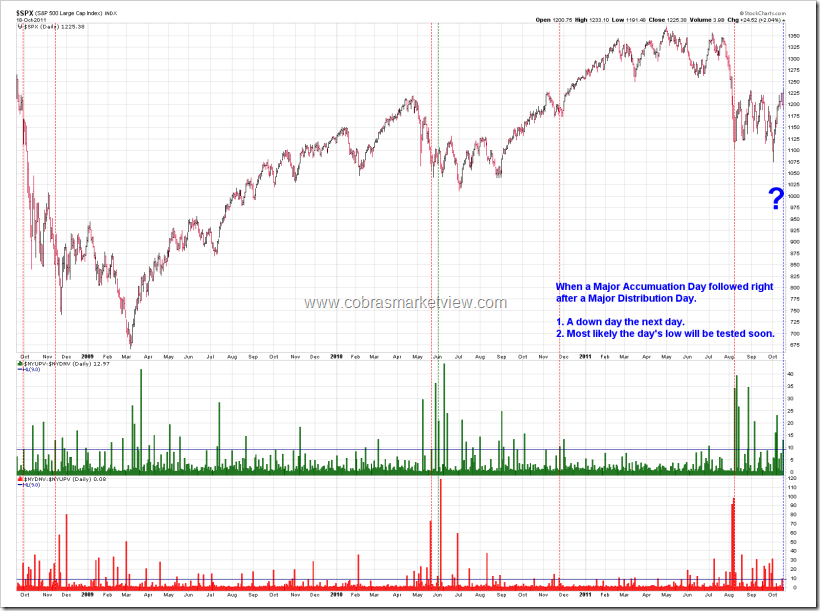

Why red tomorrow? Because it’s a Major Accumulation Day right after a Major Distribution Day.

Why more up? Because today is a Major Accumulation Day, as per the law of inertia, so it almost guarantees a higher high ahead. However due to the reason mentioned above, I’m not sure if we’ll see a higher high tomorrow, may need wait for a few days, my guess.

Now let’s talk about HOW I FEEL. Pay attention, I said FEEL which means it’s not a solid conclusion, need wait for a few days.

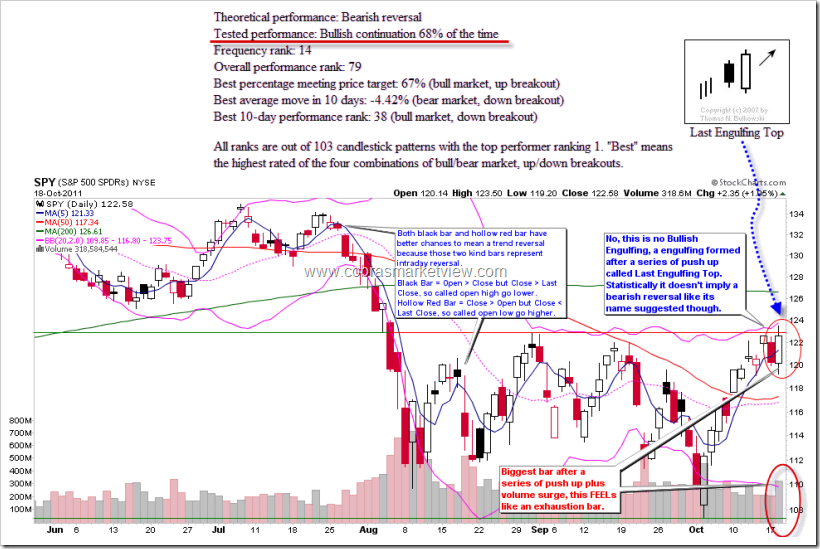

First of all, today’s candlestick pattern is not Bullish Engulfing, it’s called Last Engulfing Top, although the name sounds topping but statistically it has 68% chances to continue higher. My point is the volume surge today feels no good, plus the bar size, which are enough to make me thinking of the “exhaustion” word.

I see too much negative divergences on SPY 60 min chart. Especially the RSP lagging is no good sign, which may imply that some big guys deliberately pushed the heavy weighted stocks up (while leaving the majority stocks behind) to make indices look good, which is suspicious.

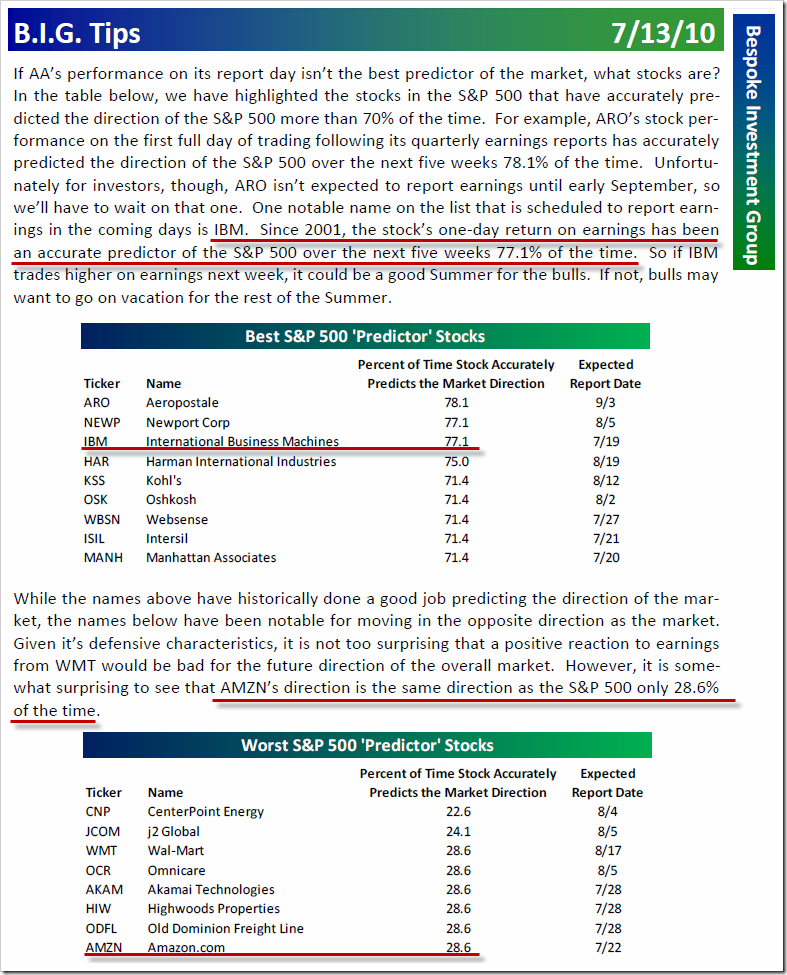

IBM dropped today after ER, which “predicted” the SPX gloomy fate in 5 weeks. The statistics below are little out of date, so I also provided the recent IBM ER chart (in comparison with SPX), looks like the statistics are still valid, only failed in the recent 2 times. In fact, if you read the chart carefully, you’d find that no matter what, SPX fell after IBM ER anyway at least since year 2010.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BULLISH MONDAY, BEARISH FRIDAY

According to Stock Trader’s Almanac:

- Monday before October expiration, Dow up 25 of 30.

- October expiration day, Dow down 5 straight and 6 of last 7.

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

Tip: Now you can use shortened name: www.cobrav.com to access Cobra’s Market View.

SHORT-TERM: IN WAIT AND SEE MODE

三点说明:

- 明天可能收红,今天的low多半会被revisit,当然,我不是说明天就revisit。

- 多半还没有涨完。

- 对大盘的前景感觉不好,但没有什么证据。看多我intraday comment的,直到我感觉还可以,所以现在我也敢把感觉当个事情来说了,呵呵。

为什么说明天会收红?因为Major Accumulation Day紧接着Major Distribution Day。

为什么说还没有涨完?因为今天是Major Accumulation Day,由于惯性,基本可以保证至少还有个higher high。不过由于上面提到的理由,我不确定明天是否就会有higher high,可能要过几天了。

下面谈谈为什么感觉不好。注意,我是说感觉不好,并没有下结论,需要看今后几天的走势再说。

首先,今天的棒棒不叫Bullish Engulfing,而是Last Engulfing Top,虽然统计上有68%的机会continue higher,不过今天最让人不放心的是放量了,有exhaustion的嫌疑。

SPY 60 min chart上negative divergence太多了。特别是RSP lagging让人很不放心,强拉权重股造成繁荣假象,非常可疑。

IBM ER后跌了,意味着SPX down in 5 weeks。下图的统计比较老,因此我又补充了最近几次IBM ER与SPX的对比图,看起来统计还是有效的,只是最近两次不准。其实仔细看,基本上自2010年开始,IBM ER后SPX都是跌。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BULLISH MONDAY, BEARISH FRIDAY

According to Stock Trader’s Almanac:

- Monday before October expiration, Dow up 25 of 30.

- October expiration day, Dow down 5 straight and 6 of last 7.

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

thx, ding

thanks dink…i feel a bit constipated and i need the market to fall hard like turds into a porcelain bowl.

lol

Thanks a lot

Wow! Cobra, You continue to AMAZE me! We are all soooo appreciative of the work you do. I don’t know why you spend so much time to provide this to us, but I am sure grateful, sir. I wish I knew a fifth of what you do. You also spend a great deal of time doing your homework. Again, thanks for sharing with us. This is an awesome report to assist us both short-term, medium-term, and long-term. Who could ask for anything more!

Thanks. 🙂

Cobra,

You are an excellent guide and well wisher for all of us. Your analysis is like a light in a dark tunnel leading us in the right direction. Words cannot express how much I and I am sure others appreciate your kindness. Thank you!

Thanks. 🙂

Cobraaa!! I love you ! Thank you so much for your hard work and your selflessness! You are truly great and seriously as everyone else said below, a true master at what you do !

Thank you for everythingg!!!!

Easy now with the love talk! I hope you are a female and hot one to boot.

Btw….did u see ISRG after Hours ? Nice triangle pop :))))))

pop it did

I beg to differ that RSP is lagging during the current rally. From Oct 4th to Oct 18th, SPY is lagging XLF, IWM, RSP, and QQQ. Having said that, the volume surge and negative divergences also make me worried, along with the fact that VIX did not make a lower low (yet). Also, the OEX put/call open interest is still a little too high.

Thx

thanks

Hey Cobra, great report! You’ve probably already looked at BAC, here’s my chart:

Thanks, I like the chart.

therefor, you showed a panda cartoon to hint us your feeling.

unfortunately, my short position was stopped out by that thunderbolt spike and still hold longs.

Hi Cobra,

According to Marting Pring, in his book “Technical Analysis Explained”, we got what he calls “Ouside Bars”. According with him, this pattern deserve an extra attention, when:

– they are very wide and engulf several candles

– High volume

– top of a very sharp trend

AJVS

Yes, be careful of outside bar.

THX

Cobra, IBM isn’t a component of NDX, neither is SAP which showed exceedingly good results a few days agp. Interesting that BPNDX looks toppish, wheras BPSPX and BPNYA look more bullish. Here the BPNDX chart:

Thanks. IBM weights 12.2% in INDU so big enough to affect INDU if IBM isn’t OK. I still believe big guys use INDU to make the market looks good or bad as it’s easy to control. IBM no doubt is their main weapon.

Yes, of course, but my main focus was/is that BPNDX looks so weak. BPNYA and BPSPX look much more bullish, P&Fs of both look bullish:

Hi Cobra, great report again!

In the past you showed charts where you could see when smart money was buying or selling. Which chart was it?

Thanks.

You mean institutional chart? I don’t use it anymore, it has no predictive power only the fact.

Or you mean Sentimentrader Smart Dumb money confidence chart? It’s neutral, nothing to say now.

Ok thanks for reply.

—– Reply message —–

Van: “Disqus”

Aan:

Onderwerp: [cobrasmarketview] Re: 10/18/2011 Market Outlook (No, it is not Bullish Engulfing) Datum: wo, okt. 19, 2011 15:41

Disqus generic email template

Cobra wrote, in response to sigmaecho:

You mean institutional chart? I don’t use it anymore, it has no predictive power only the fact.Or you mean Sentimentrader Smart Dumb money confidence chart? It’s neutral, nothing to say now.

Link to comment

thanks cobra laoda

Thank you for the great work!

thanks a lot