SHORT-TERM: COULD SEE LOWER CLOSE AHEAD

First of all, don’t forget our poll HERE, at least take a look at the result (which is my real purpose: To let you know the current sentiments). It’s very interesting because since we had the poll, never was once bulls were the majority except this time (so far), although not much margin.

Three cents:

- The seasonality around the Thanksgiving week is very bullish, especially the Wednesday, Dow up 8 out of 9 since 2002. So the general trading strategy is to buy Monday or Tuesday weakness then sell into Friday strength. I’ve noticed that such a routine hasn’t preformed well since the year 2006, so might not a bad idea to sell at least half into Wednesday’s strength. Be careful not to hold until the next Monday (11/28) because Dow down 7 out of 9 since 2002 on the day. For more details about the Thanksgiving seasonality, please refer HERE (since the Seasonality topic can be repeated every year, so it’s not part of my daily Mark Outlook anymore, instead I’d gradually add those topics under the “Seasonality” menu), and also you can find similar tips at the Trader’s Calendar on the top right corner of the site’s front page.

- For the short-term, I expect a lower close ahead, at least lower low is more likely.

- For the intermediate-term, although officially the downtrend has yet confirmed, I believe the game is over for bulls. There’re 47% chances a green week the next week and that’s it, after that we’d see multiple weeks selling (80% chances). I’ll discuss this in the intermediate-term session later.

Why do I expect a lower close or at least lower low ahead?

- I’ve mentioned the chart below in the 11/17 Market Outlook that an official intermediate-term downtrend starts only when $120 is broken. From the Pennant pattern formed on the Friday, I believe chances are high that $120 wouldn’t hold.

- Never should a strong uptrend have 3 consecutive down days. Unfortunately, Friday is the SPX’s 3rd consecutive down day. From the chart below, clearly chances are high there’d be a lower close ahead.

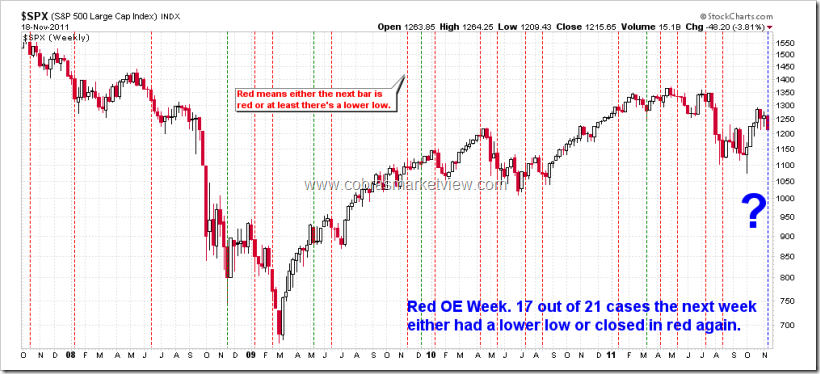

- Red OE week means 17 out of 21 (81%) chances at least a lower low the next week.

- In the intermediate-term session below I’d mention that 12 out of 15 (80%) chances we’d see a lower low the next week.

- The last but not the least, don’t forget what I mentioned in the 11/17 Market Outlook that chances of a lower low ahead after a Major Distribution Day and a Non-Stop model sell signal are pretty high.

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

The chart below explained why I believe we’d see multiple weeks of selling ahead (I don’t mean red every week of course):

- NYSI weekly STO sell signal is very reliable when the long-term signal is also on the sell side. We’ve had 2 consecutive exceptions (also the only 2 exceptions), I don’t believe we’d see the 3rd exception, because the 3rd time is the charm.

- Statistically:

- 7 out of 15 (47%) chances we’d see a green week the next week.

- Only 3 out of 15 (20%) chances the SPX would rally for 2 more weeks from here.

- Also only 3 out of 15 (20%) chances the SPX would rally the next week without forming a lower low first, i.e. gap up Monday and never turns back.

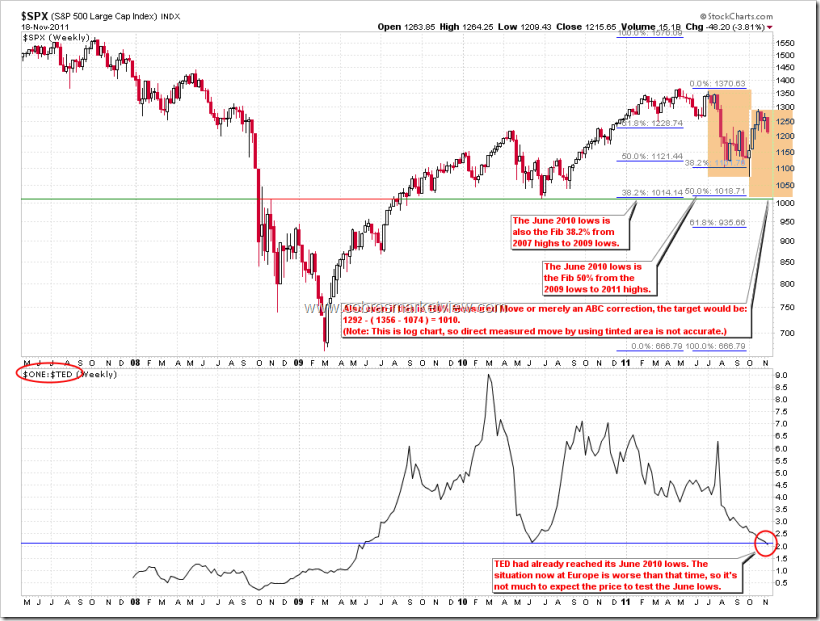

The chart below explained why the selling target would be around June 2010 lows:

- Fib confluences area.

- Measured Move target.

- TED Spread had dropped below its 2010 lows.

- Usually the monthly BB bottom is the target which now happens to be around the June 2010 lows.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: COULD SEE LOWER CLOSE AHEAD

首先,别忘了投票,至少看一下投票的结果吧,很有意思,因为自从我们开始有投票以来,还从来没有过牛牛占据多数的情况,虽然领先不多,呵呵。

三点说明:

- Thanksgiving week seasonality是很牛的,特别是周三,Dow up 8 out of 9 since 2002。所以一般trading是buy Monday or Tuesday weakness then sell into Friday strength。不过自2006年以来似乎这样的trading不行了,因此可能sell at least half into Wednesday’s strength比较稳妥。注意,不能拿到下周一(11/28),因为Dow down 7 out of 9 since 2002。关于Thanksgiving的seasonality,请参看这里(因为seasonality这个东东,至少每年都要重复一次,所以我不再把它编排在daily Market Outlook里了,以后类似的讨论将放在Seasonality menu下面),此外主页右上角Trader’s Calendar里也有提示。

- 短期应该还有跌,I expect a lower close ahead,至少至少lower low吧。

- 中期,虽然目前officially下降趋势还没有确认,不过基本上牛牛已经大势已去了。不排除下周反弹收绿的可能(47%的机会),但是that’s it,后面应该是multiple weeks selling(80%的机会)。关于这个判断,将在intermediate-term session里讨论。

下面解释一下为什么说短期还有的跌:

- 下面的图我在11/17 Market Outlook里提到过,只有跌破了$120才可能算officially intermediate-term downtrend。从周五pattern看,多半是个Pennant,因此多半$120会跌破。

- Strong uptrend是不应该出现连跌3天的情况的,很遗憾,到这个周五为止,SPX已经连跌3天了,从下面的图看,很大几率会有lower close ahead。

- Red OE week意味着17 out of 21 (81%)的机会下周至少会有个lower low。

- 后面intermediate-term session里还会提到,12 out of 15 (80%)的机会下周会有lower low。

- 最后别忘了在11/17 Market Outlook里提到的,lower low after a Major Distribution Day以及Non-Stop Model的sell信号,都意味着下周至少会有个lower low。

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

下面的图是我认为会持续跌几周(不是说每周都红哈)的理由:

- NYSI weekly STO sell signal在long-term signal也是sell的情况下是非常准的卖信号。我们已经有连续两次例外,且是仅有的两次例外,我不认为第三次还是例外,要知道,the 3rd time is the charm。

- 从数据上看:

- 下周有7 out of 15 (47%)的机会收绿。

- 只有3 out of 15 (20%)的机会SPX持续反弹两周以上。

- 也只有3 out of 15 (20%)的机会下周没有lower low就直接上涨。

下面的图说明了为什么下跌目标可能是2010年6月的lows:

- Fib confluences area.

- Measured Move target.

- TED Spread已经跌破2010年的lows了。

- 通常monthly BB bottom是target。现在的位置正好是在2010年6月的low附近。

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Thanks for sharing and have a nice weekend!

thx, ding

Cobra: sound too bearish, so no Santa rally this year? 🙁

So is it safe to initiate short positions yet?

There’ll be a Santa Rally.

As for short, you know I’m not allowed to recommend position. 🙂

Great analysis as usual. We can still have a mild Santa Rally. Take a look at what happened at the end of 2001 and 2002 on the weekly STO chart. One thing that keeps me bugging for the bullishness call early this week is the news (or no news) from the super committee for the budget cuts. Anyways, let us see what happens. I believe that 2012 will be a volatile year, which is good for traders…

Yes, I believe Santa Rally too.

Neither shorts nor longs got a chance to load up properly. Low volume indecision rotations might continue for some time to frustrate both sides.

P&Fs don’t predict a Santa Rally for the yearly statements of Baby Boomers. Here the traditional and the ATR. Liklihood that SPX goes back above 1230 correlates with the probability of a successful ascent of Eiger North Face in December. For precise support levels for next week pls check BB13/1 on the weekly and monthly charts at stockcharts.com, I see 1204, 1202 and 1187…

I still believe Santa Rally.

How high will the Santa Rally go to Cobra ? Thanks

Let’s see pullback first as now I’m worried, seems everyone believes my bearish view. 🙁

If traditional P&F shows “sell” the market is heading south or sideways – well, that’s my belief.

By the way, I just finished a small Gann on SPY and it shows support at 120.40 – same message as the BB13/1s on the weekly and monthly SPX charts. So there could be a smallish bounce there…

Cobra, by Santa Rally do you mean – a rally that starts around 12/22 and goes thru 1/2 or something else? Thanks!

Last 5 days of 2011 and the first 2 days of 2012.

Ok, I had some spare time, here a close look at BB 13/1 on the weekly and monthly:

This was my prediction chart from October and we seem to be on track and matches Cobra’s target as well…

http://1.bp.blogspot.com/-iJFVTrtCUTg/TqTI3iykx-I/AAAAAAAAAeM/2NsiHHQPYho/s1600/s%2526p_longterm_oct24_2011.png

cobra – regarding the red OE week stat, the 4 times where was a bounce, we were coming off of multiple down weeks. Currently we are down only one week.

Something short and sweet keeps coming to mind:

After getting started with a bang, complete with a rare Zweig Breadth Thrust signal, that put one of the biggest monthly candles ever on the charts in what is a seasonally bearish month, a total reversal would leave one hell of a bull trap on the charts, and would be EXACTLY WHAT ONE WOULD EXPECT from a healthy, mature bear market, but without really realizing it at the time (hence the bull trap). Last week’s EOD nasty sell-offs on Tuesday and Wednesday, leaving obvious intraday bull traps in place, may serve as fractal warning shots.

That’s simplified of course. The bullish setup was (is?) huge and supported by many more indicators, sentiment, cycle projections, etc., and IF we get a failure, I’m thinking expectations for something just as huge to the downside would be reasonable.

I’m surprised no one I’ve read this weekend has even commented on the rare occurrence in the options market. The total put/call ratio came in at 0.89 and CPCE came in at 0.90. This has to be the first time I’ve EVER seen this occur in many years (CPC < CPCE). It may have, but this was a very very rare event. Yet no one has even researched what it meant for the short term and intermediate term. I think there is more downside but this particular metric would seem to confirm a bullish bias (dip buying mentality) into the end of the year since equity option traders are rarely right about the big picture.

Sentimentrader did a report about CPCE > CPC and accordingly I did my own test, I didn’t see any bearish short-term edge as Sentimentrader said, so that’s why I didn’t say anything here.

Unlike text book said, usually CPCE leads, it’s not a contrary indicator, and this is actually what my Non-Stop model based on. Also my “famous” CPCE trend line for detecting the top also based on CPCE leads the market and so my VIX leads theory.

True, I’d say CPCE being high indicates a little bearish bias for the short term. However, it is pretty obvious from all backtests that when CPCE gets above 0.90 the market is closer to a bottom than a top. When people start buying lots of puts, they are always too late.

This part, I agree, everything has a limit. The most difficult thing is no one knows where the limit is.

I’ve not seen where the Big-Money ($CPCI) and the Retail-Money ($CPCE) have

been … COMPLETELY-OPPOSITE !?!?!?

I’m leaning towards at least a 1-(maybe-momentum-2)-day-rally … AND

the (more significant CPCs?) $CPC and $CPCI did DROP (for 2-days now and Friday was a HUGE-DROP) … BUT

the Market(s) Remained-(for the most part)-FLAT … AND

the VIX-(and VIX-Futures)-Fell … THEREFORE

–

Sentiment: Leading/Hinting to a (strong?) possibility that the Market(s) are

Behind-the-(upward)-Curve ??? … (or Bit-o-Market-Rally … coming to a theater

near you ???)

West_TX_Trader

Put call ratio really strange those days, I don’t recall I saw them act like nowadays.

My Theory:

The $CPCs are the KEY to knowing WHICH-WAY the Market(s) will Turn … (or Bear-Excess = Bear-Rally, Bear-Limited = Market-Dump) … AND

using the Currencies to Nudge? (and/or SHOVE?) the Markets in whichever direction is Goal-Suitable.

–

My Humor:

LOOK, it’s a Bull-Market!!! NO, it’s a Bear-Market!!!

NO, it’s a SUPER-WHIP-LASHING-TRADING-WAR !!! … (as in World-Banks OR PERHAPS it is “Europe’s Plan-of-Plans.” ???)

OR

Until THAT concept/approach QUITS-WORKING for them ??? … (then Look-Out-2008-Below ???)

–

My Approach:

Closely-Monitoring/Watching the: CPCs, SCANs, EURO/FXE, USD/UUP, the $SPX’s 10/13/15,30, 60-Minute MACDs and corresponding 5,8,20-Period-Moving-Averages for Additional-Clues.

Cobra: I really enjoy the overlay of spx and 1/ted. Simply amazing!

Unless the two start to decouple, your predicted target is not overly expected imo.

Hi Guys,

Just a reminder:

– Next Wednesday is the deadline for US Senate comitee to decide about some budget cuts. It seems that there will be no agreement.

– According Yahoo (news were posted several weekas ago), Fitch already decided to downgrade US rating. However they are still waiting for the obvious, no agreement in order to decide for it.

Conclusion

Cobra´s target for SPY is very likely to happen very shortly

Cobra

Did you notice the extreme divergence between cpci (they’re bullish) and cpce (they’re bearish) on Friday? Plot CPCi:CPCE and you’ll see what I mean. This must at least short term bullish.

Also wondering if you have a Rydex update.

Many thanks,

Rydex still bullish.

Yes, I noticed that put call ratio acted very strange those days, don’t know what they mean. Guess we’ll have to wait and see. I just cannot believe we’ll see another NYSI sell signal exception. Really, I don’t believe. But now as everyone seems bearish here, I’m really worried. 🙂

Last

time we took data from 2008 and added it to our current data the

results where stunning! Our post on October 9, 2011 says it all and

caught over 100 ES point rally! Our overarching view of the market

hasn’t failed us yet, so let’s try a trick that worked for us recently.

We’re going to steal data from 2008 and add it to our current data.

http://www.bostonwealth.net/2011/11/20/morties-weekend-update-20nov2011-deja-vu-again-2/

Santa Rally fans (such as Cobra) should closely inspect this chart: support 1205/1210 is more important than I previously thought. A break under 1205/1210 on a closing basis suggests further weakness.

Santa Rally is simply because of holiday volume too thin, nobody sells into thin volume as it’d cost too much, so most likely it’d rise.

I mean what is a Santa rally. if we move up 5% for a week or two in dec.. there’s ur santa rally even if we start at lower prices than here. We could even be smoked sausage heading into Santa and if we rally for a week or two, there’s ur santa rally

If INDU leads, as you say Cobra, the relative strength late last week vs. the SPX can only be interpreted as being bullish for the market.

Right, INDU is strong.

Go Browns!!!!!

Very gloomy for next week. Any rally is artificial and will be sold. I will sell

any top. Either Oct 20 low (1,197) or Oct 17 low (1,192) will be revisited on Monday or Tuesday latest.

TTTTIIIIMMMMMMMBBBBBEEEEEEERRRRRRRRRRRRRRRR!!!!

Could it be a positive divergence by open tomorrow? Just a wild guess.

Doesn’t matter, if we lose 1190-1200 that’s going to be ugly. Watch price and trade accordingly.

Well it kinda does because I will use rally as opportunity to load shorts. As of last Thursday I unloaded my shorts and now totally in cash and in wait-n-see mode.

Sorry…please disregard previous chart

Hi Cobra, I feel I learn more about money markets from you then I do from my finance department. Many thanks. I was curious if you could tell me the stockcharts overlays/parameters you use for your long term trading signals you presented this weekend. Thanks again.

MACD( 13, 34, 1), it’s basically to watch weekly EMA13 and EMA34 crossover.

Cobra,

Thursday opex week low – generally equals Monday low (recent examples July and April 2011)

Last 4 years, low in SPY has occurred on Monday after Thanksgiving (even after Dubai in 2009)

Lastly, this table from Schaeffer’s research is interesting as Monday’s close has predicted the direction of the weekly close since 2000.

http://www.schaeffersresearch.com/commentary/observations.aspx?ID=108892&obspage=2

I like the idea of buying Monday and selling Wednesday… though in 2008 – it was sell Friday! as we collapsed 8% on the following Monday.

-D