0.0.0 Signal Watch and Daily Highlights, today many indicators predict that the market might have bottomed. You may refer to my chart book by the chart numbers.

Are we there yet? I tend to think not yet. However there are so many reliable signals which have track records in the history, from now on my analysis may involve a factor of guess, so you may need to do your own due diligence. My suggestion is to reduce the weight on short positions, but wait for a while before opening long positions.

Besides technical indicators, my criteria to judge a market bottom is essentially panic. How can a market be panic? Take a look at the following chart. Since the last year, it is typical that the market drops for at least three days before a bottom. Today is the first down day, isn't it?

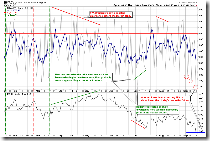

2.0.0 Volatility Index - NYSE (Daily). VIX has broken out of ENV massively, which is good. According to the patterns on the chart, does the market reach a bottom while VIX is such a big while candle? Usually the bottom day is a sharp intraday reversal, while VIX closes at a black candle, or Doji (cross). Now VIX candlestick pattern is different, right?

2.4.2 NYSE - Issues Advancing. Today the curve has another lower low, which means the selling strength is not weakened, and SPX may have a new low close that is lower than 1192. As I mentioned previously, the market usually does not reach a bottom before a positive divergence appears on this chart. Now we have not seen it, have we?

The green curve on T2101 on the Telechart goes up steadily, which means the absolute value of the difference between Advancing and Declining is enlarging continuously, in turn this says the selling strength has not been weakened. On this chart, usually the market reach a bottom after the brown curve (10 day moving average of the green curve) goes down for some time (which means the difference between Advancing and Declining is decreasing -- the selling strength is weakening). At this moment, however, the brown curve is still rising.

5.3.0 Financials Select Sector SPDR (XLF Daily), today it broke down with heavy volume. Since there is no significant support below the current level, it seems Financial sector may go down to test the July bottom, which is very bearish.

As a summary, I think the market probably is not at a bottom.

Tomorrow is the Fed Day. Concerning the Fed Day, allow me to reiterate that:

- At least lock some part of your profit;

- On the Fed Day, the market may behave like a roller coaster -- go up hundred of points in minutes, then go down hundred of points in minutes, then go up... So experienced traders will take a rest tomorrow.

- The true direction of the market will not reveal itself before a few days later. If the market goes up tomorrow, bulls should not feel too excited. If it goes down, bears should not feel too relieved either.

3.0.1 Yield Curve, the difference between the current value and the Fed Rate is huge, which implies that the market expects a rate cut. Tomorrow Fed may, I guess, cut the rate by 0.50. In addition, US3TM goes down sharply which is not good. Actually the current level is lower than the July low (note the red circle), which means we have a bigger trouble than we did in July. Does it imply that the July low will be taken out?

Here are some interesting charts.

1.1.8 PowerShares QQQ Trust (QQQQ 60 min), it seems QQQQ is forming a bullish falling wedge.

1.1.C TRINQ Trading Setup. Today TRINQ closed at above 2.0, which predicts that QQQQ might go up. The success rate of this setup is 68% so far.

1.4.3 S&P/TSX Composite Index (15 min), Bullish Falling Wedge.