Today the market pulled back as expected. Although the selling-off is a bit massive, the mid-term buy signals are still valid. However the trend could be changed if the market goes down tomorrow as much as today, then the last Thursday bottom could be tested.

Will the market go further down? My conclusion is that a rebound is possible, and even if the pullback continues the magnitude will not be as huge as today.

The following chart shows the evidence for rebound. Since September, there have been never two down days in a row. If this pattern is continued to be valid, hopefully the selling-off will not appear tomorrow. Furthermore, VIX at the bottom of the chart is still overbought which favors a rebound of the market.

1.0.4 S&P 500 SPDRs (SPY 15 min), 1.2.7 Diamonds (DIA 15 min). The pattern on 15-min charts look like a Bullish Falling Wedge, which may possibly cause a rebound of the market. In addition, RSI is oversold and at a level where the market usually does not plunge hard.

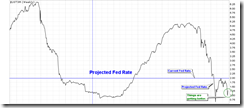

3.0.1 Yield Curve. The yield is going up which means the things are getting better.

3.1.0 US Dollar Index (Daily). US dollar is oversold and testing the Fib 50 and 50-day moving average. If the drop stops here, the market could be improved.

3.4.3 United States Oil Fund, LP (USO 60 min). Oil is overbought.

2 Comments