OK, are everyone bullish when AH news came out? Well, I'm preparing to be bearish now (pay attention to "preparing"). Reasons:

1. Up 3 days, still couldn't recover the Jan 20's one day loss.

2. 1.3.7 Russell 3000 Dominant Price-Volume Relationships, again today has 1197 stocks price up volume down. Up 3 days in a row with volume down 3 days in a row, this is a typical pullback setup.

3. I mentioned here 01/23/2009 Market Recap: Extremely Low CPC Reading... about extremely low CPC readings are bullish, but this is only the half part. The other half is, a sell off generally follows. When will the sell off come? I don't know. But since we know a sell off usually follows, we should be careful here. Anyway, in today's report, I will talk about a trading setup which combines SPX:CPCE, CPC and NYADV together where at the same time we can see from the past, typically a sell off does follow.

7.0.3 NYSE Composite Index Breadth Watch, according to the "Equal up down strength rule", up 3 days in a row still no higher high, bears won. Also, volume down 3 days in a row which in normal market conditions, a pullback is due. For more examples about "Equal up down strength rule" please refer to chart 8.1.1 Buyable Pullback Rule.

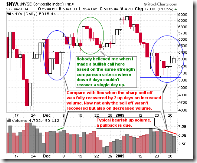

2.8.2 SPX:CPCE, MACD buy signal, good, which is pretty accurate in the past. But if we simply follow the MACD here, we will lose lots of profits, especially when the MACD buy signal is generated by extremely low CPC readings as in this case a big sell off usually follows. Why big sell off? Simple, extremely (pay attention to "extremely") low CPC readings can hardly be lower so it eventually has to rise which means a pullback in the overall market. So is there anyway to take profits just right ahead of sell off? The answer is NYADV. Extremely low CPC readings tend tol make the market rise in an extreme way therefore usually cause NYADV to reach an overbought level. Today it seems that all these conditions are met, except the NYADV overbought, hopefully market can rise to the overbought level, which I doubt, by the way. Anyway, Fed day tomorrow, market typically roller coaster after 2:15pm, so before 2:15pm better take some profits. And also from the chart, we can see in the past the best case is up 5 days in a row and the market has been up 3 days now, so be careful.

2.0.0 Volatility Index (Daily), pay attention to STO indicator, if market up big tomorrow, this chart can be another reason to take profits.

1.0.3 S&P 500 SPDRs (SPY 30 min), could be a small Symmetrical Triangle, so might be up tomorrow. Just the STO is a little bit high, so price could rise then fall tomorrow. 1.1.5 PowerShares QQQ Trust (QQQQ 30 min), possible Ascending Triangle, could rise. The same, STO indicator is a little bit high.

8 Comments