Summary:

Bulls have 4 days to push above SPX 930 to prove themselves.

Expect a pullback tomorrow.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | All but one intermediate-term sell signals are confirmed. |

| Short-term | Up* | Neutral |

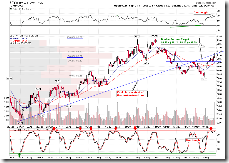

The strength of the today’s really is really a surprise to me. If this kind of strength goes on, then very soon, all the intermediate-term sell signals generated last Friday would turn out to be a whipsaw. So now 7.1.0 Use n vs n Rule to Identify a Trend Change should be used to determine who’s stronger bull or bear. Since it took bears 5 days to push SPX from 930 down to 878, then we should give bulls equally 5 days (including today) to see if they can push SPX higher than 930.

Tomorrow, I expect a pullback and a red close.

1.0.3 S&P 500 SPDRs (SPY 30 min), very short-term very overbought, so expect a pullback at least tomorrow morning.

2.8.0 CBOE Options Equity Put/Call Ratio, way too bullish, from the chart we can see whenever CPCE readings were this bullish, the 2nd day was not very pleasant with no exceptions so far. So accordingly, I expect a red close tomorrow.

The follow charts are your info only.

1.3.7 Russell 3000 Dominant Price-Volume Relationships, 2 dominant relationships today: 1361 stocks price up volume down which is bearish; 1274 stocks price up volume up which is bullish. So I don’t think it’s actually bearish for having today’s up on decreased volume.

1.0.2 S&P 500 SPDRs (SPY 60 min), well, it seems OK SPY could have as many gaps as it wants as long as it’s an up gap. So far bulls have 7 unfilled gaps while bears have only 1 now(within short period).

6 Comments