Summary:

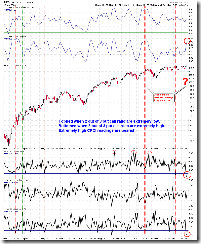

Expect a short-term pullback soon.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 12/21 L |

*Adjust Stop Loss |

*breakeven | |

| Reversal Bar | 12/21 L |

*Adjust Stop Loss |

*breakeven |

|

| NYMO Sell |

|

|||

| VIX ENV | ||||

INTERMEDIATE-TERM: BULLISH SEASONALITY BUT MARKET MAY NOT UP HUGE

Nothing new, very bullish seasonality, see12/18/2009 Market Recap, but since the Options Speculation Index is way too bullish so I doubt how high the market could go.

As mentioned in today’s After Bell Quick Summary, something big is going to happen. Unfortunately I don’t know if it’s bullish or bearish. However, 0.0.9 Extreme Put Call Ratio Watch argues for a top again today and this time it adds one more red cycle. So as usual, the cliche: It’s OK to be bullish but proceed with caution.

SHORT-TERM: COULD BE A PULLBACK SOON

No idea about tomorrow. However for all the indicators listed in www.sentimentrader.com, there’re 30% of them at bullish extremes today. The last time I mentioned this was in 12/14/2009 Market Recap, SPY had almost 4 days down swing thereafter. So again, be careful here.

INTERESTING CHARTS:

1.4.0 Shanghai Stock Exchange Composite Index (Daily), the Bearish 1-2-3 Formation is confirmed.